Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Tag: philosophy

The Long View Library: Books Worth Reading & Sharing

Many of the people we work with tell us they value not just our diligence and professionalism, but also the personal touch and team chemistry that make working together feel special. In that spirit, we’re pulling back the curtain to share what’s been on our bookshelves lately and why these titles resonated with us. Think of it as an open invitation to browse, discover, and maybe even find your next great read or a thoughtful gift.

Let’s start with my suggestion:

Odds On: The Making of an Evidence-Based Investor by our own Matt Hall is a thoughtful overview of our evidence-based approach, how it reflects academic insights, and how it contrasts with more traditional investing methods.

You may have read it at some point over the past decade, but your friends and family—especially the next generation of investors who were too young when it debuted in 2016—may not have had the chance.

If you or someone you know would like to explore our investing philosophy, we’re happy to share a complimentary copy. There’s no cost or obligation. It’s simply a resource we’re proud to pass along. Just email me and we’ll send one your way. Short on time or attention? Email me for a two-page summary. Prefer audio or Kindle? Those versions are available too.

Now, onto more team favorites for you to explore:

I’ve been leaning hard into fiction lately and found some real gems. Pachinko is an epic family story set in Korea and Japan, surprising and moving in how it explores generational identity. Tom Lake is a beautifully written portrait of family and choices that shape a life. The Night Circus—magical realism, stunning imagery, and an immersive mystery—is pure escape. My latest nonfiction read was Good Morning, Monster: powerful real-life stories of resilience that stay with you.

In fiction, I recently reread A Tree Grows in Brooklyn, a timeless favorite. I also enjoyed The Magnificent Lives of Marjorie Post (a great example of someone who took the long view). The Favorites is a story about figure skaters I picked up for nostalgic reasons—think The Cutting Edge. Lady Tan’s Circle of Women scratched my historical fiction itch. On the nonfiction side, The Anxious Generation has been especially helpful as a mom looking to support calm and confidence in my kids.

Going Infinite (by Michael Lewis) offers a fascinating look at Sam Bankman-Fried and the broader crypto narrative. It’s a complex profile of someone who became a central figure in one of the biggest financial stories of the decade. For fiction, Project Hail Mary (by the author of The Martian) was a standout, and Tomorrow, and Tomorrow, and Tomorrow might be one of the best books I’ve read in a while. For a lighter beach read: Nora Goes Off Script.

Good Morning, Monster was a recommendation from Matt, and it’s now one of my top five books. It shares a therapist’s most difficult cases—dark, yes, but incredibly insightful. It helped me appreciate how much childhood experiences shape adult life.

A fiction book I recently loved is Tomorrow, and Tomorrow, and Tomorrow by Gabrielle Zevin. It follows two childhood friends who reconnect in college and begin designing video games together. What stood out most was the deep, complex relationship between the two main characters, intimate without being romantic. It was refreshing and emotionally rich.

My favorite nonfiction book is Endurance: Shackleton’s Incredible Voyage by Alfred Lansing. It tells the gripping true story of Ernest Shackleton’s 1914 Antarctic expedition, where his crew endured an unimaginable struggle for survival after their ship was crushed by ice. It’s an unforgettable story of leadership and perseverance.

We’d love to hear what you’re reading, too. If you have a book you’d recommend, please send it our way, along with a short note about why you loved it. With your permission, we may feature your suggestion in an upcoming issue of the Monthly Journal.

Markets Don’t Wait for Official Announcements

Over the last several months, “tariffs” have made frequent headlines. They’re on. They’re off. They’re up. They’re down. Understandably, many investors are asking: How will this affect my portfolio?

Here’s the short answer: the market doesn’t wait for official announcements—good or bad. Every second global financial markets are open, prices are adjusting in real time to reflect all known information, whether that information is accurate, speculative, or incomplete.

This is why reacting to headlines or trying to time the market based on “breaking news” often proves unproductive. The news is already priced in.

At Hill, we help clients build portfolios rooted in long-term planning, academic research, and thoughtful consideration of risk. These portfolios are designed with the understanding that market fluctuations and unexpected headlines are part of the journey.

Rather than react to each new cycle of uncertainty, we focus on your plan, your risk tolerance, and the full breadth of evidence available. This approach is intended to help clients remain invested and confident, even in the face of short-term volatility.

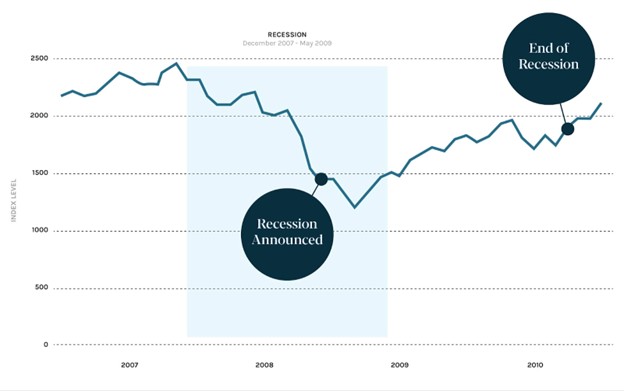

The included graphic from Dimensional illustrates how markets respond to news events. It highlights a consistent truth: while headlines can move markets temporarily, disciplined, diversified investors who stay the course are often better positioned over the long term.

If you have questions about how your portfolio is structured to weather market headlines—or want to revisit your plan—we’d be happy to talk.

Master Yourself (and let us help)

One of our all-time favorite columnists, whose insights we’ve shared here before, is Jason Zweig of The Wall Street Journal. Jason authors “The Intelligent Investor,” a column named after Benjamin Graham’s classic book—often referred to as the ultimate guide on investing. (Warren Buffett calls it “the best book about investing ever written!”)

One of our all-time favorite columnists, whose insights we’ve shared here before, is Jason Zweig of The Wall Street Journal. Jason authors “The Intelligent Investor,” a column named after Benjamin Graham’s classic book—often referred to as the ultimate guide on investing. (Warren Buffett calls it “the best book about investing ever written!”)

Jason’s opening line in his latest article sums up a core message you’ve seen here for years and in our client letters:

“Investing isn’t about mastering the markets; it’s about mastering yourself.”

Put simply, your behavior as an investor has a greater impact on your long-term returns than any market movement. This is where we come in—to help you stay calm and fully invested, whether markets are booming or turbulent.

As Benjamin Graham said in 1949:

“The investor’s chief problem—and even his worst enemy—is likely to be himself.”

In today’s environment, staying steady is harder than ever with social media, trading apps, and online distractions. For more on why, we highly recommend Jason’s full article here, which includes links to further resources. And of course, we’re always here to talk through any of these topics—just give us a call or schedule a time here.