Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: presidential election

Do Politics Belong in Your Financial Plan?

With politics being everywhere in this heated time, it’s natural to wonder, do politics belong in your financial plan? A recent article in the New York Times looks into just this question.

The key point: as an investor, your advisor’s views should have no part in your plan. At HIG, you and your personal wealth goals are what matter to us. If you want your politics to be a part of your future goals, we will help you decide how to do that. Our politics will not enter the picture.

If you are not a client of ours, and are worried that your advisor’s political outlook is influencing their advice to you, here are some suggestions taken directly from NYT the piece:

- If you think politics factor into your adviser’s strategy for your nest egg, ask for explanations. A good retirement planner will be able to articulate how the actions taken by politicians can — and can’t — affect your portfolio.

- When emotions are running high, resist the urge to dismiss your adviser on the spot — a knee-jerk reaction when it comes to your retirement security isn’t a great idea. Don’t do anything that’s not part of a long-term investing strategy.

- Talk to your adviser about how specific economic policies affect your portfolio. Politics might be about people, but your investment decisions should be informed by the ramifications of, say, bond-buying or tax-code changes.

- Try to keep an open mind. A different viewpoint from one you hold might give you valuable insight for your long-term savings goals.

- If you want to integrate your political views more directly into your retirement planning, some advisers suggest working with someone who has knowledge and expertise in E.S.G. (environmental, social and governance) investing strategy.

At HIG, we have a single-minded focus on putting the odds of your long term success in your favor. And, as fiduciaries, we are legally bound to work in your best interest. Period. We are passionate about what you need from your plan to help you live the life you want, and give you peace of mind.

So, our message during this period will sound familiar to our long-term followers: focus on what you can control, keep calm, and take the long view. Your nest egg and legacy will thank you.

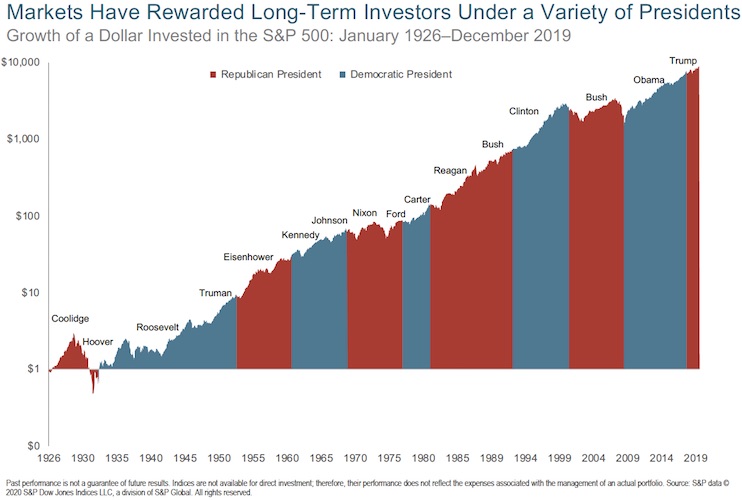

Does Your Money Care Who Wins the Election?

We send our clients exclusive quarterly communications. To give you an idea, here is the graph we provided in our recent letter. The key question asks if your money cares who wins the election. Want to know more? Schedule a quick call with me to discuss and find out what other perks our clients receive.

The Great Debate – Election Years vs. the Stock Market

Whether your political views are right, left, or somewhere in between, you should check out this video. Election years tend to heighten everyone’s anxiety. This video does a great job of helping us as investors understand what to do.

As changes to tax reform, foreign policy, and social issues loom, it’s totally natural to be tempted to make short-term portfolio changes to profit from the uncertainty, or to minimize losses. But, as we know, markets are extremely efficient at processing new information and adjusting prices based on future expectations, so research would tell us any fears or expectations about the results of the presidential election are already baked in.

So, what’s a savvy investor to do? Our friends at Dimensional Funds skillfully reframe the perspective provided by the regular media.

Going back to 1928, when Herbert Hoover was elected president over Al Smith, the S&P 500 has returned on average 11.3% during election years and 9.9% in the subsequent year. In fact, there have been only three presidents in history that have seen negative returns in the stock market over their presidential tenure: Herbert Hoover during the Wall Street Crash of 1929, Franklin Roosevelt during the Great Depression, and George W. Bush in the 2000s during a time known as the Lost Decade.

Our takeaway? Make sure your investment plan fits your goals and stick with it. No matter what the regular media is saying, the data shows whoever is in the White House is unlikely to negatively impact the long-term value of your nest egg.