Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Zenz

Wisdom of Crowds

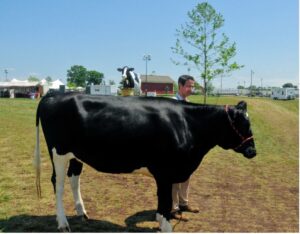

In the heart of a bustling county fair, an extraordinary experiment unfolded, showcasing the incredible power of collective intelligence. A seemingly whimsical challenge emerged: Guess the weight of a cow on display. What initially appeared as a playful game soon transformed into a stunning demonstration of the “wisdom of crowds.”

A diverse group of fairgoers, each with varying degrees of knowledge and intuition, were asked two simple questions: How much does this cow weigh? Do you have any experience with the weight of cows? The goal was to see if anyone in the crowd could guess the correct weight and if experts would be superior to the average individual.

A fascinating phenomenon began to unfold. Although individual estimates ranged wildly, the average of all these guesses astonishingly approached the actual weight of the cow. In the end, the average guess for the non-experts was 1,287 pounds compared to the actual weight of 1,355 pounds. A difference of only 68 pounds. A bigger surprise: the expert’s average guess was less accurate at 1,272 pounds, a difference of 83 pounds.

The genius of this collective average lay in its ability to filter out errors and biases inherent in individual guesses. High estimates countered low ones, and the middle-ground approximations formed a consensus that defied the odds. This experiment showcased the concept of the “wisdom of crowds” that a diverse group’s collective knowledge can outperform the insights of any individual expert.

Translating this concept to the realm of financial markets, where stocks are traded and their prices determined, demonstrates a similar effect. The market comprises countless participants, each with their own insights, analyses, and biases. When these factors converge, the resulting stock prices tend to reflect the most accurate estimate of a company’s value at a given point in time.

This phenomenon finds its backbone in the Efficient Market Hypothesis (EMH), which proposes that stock prices encapsulate all available information. Much like the cow guessing average, EMH posits that the combined insights of countless individuals lead to fair and accurate valuations, making it incredibly challenging to outguess the market consistently. Financial markets react to new information quickly, updating prices to reflect the most up-to-date information and risks fairly. Rather than trying to outguess market prices, causing turnover, high fees, and trading costs, one is better off accepting and using market prices to your advantage. Invest in global capitalism rather than trying to outguess it.

From guessing the weight of a cow to the intricate world of financial markets, the wisdom of crowds continues to shape our understanding of collective intelligence. Just as a diverse group of fairgoers could accurately estimate the cow’s weight, the multitude of participants in financial markets work together to create prices that reflect a collective estimate of a company’s value. The efficient market hypothesis stands as a testament to the power of this concept, reminding us that while individual expertise is valuable, the aggregated insights of many can often lead to more accurate and reliable outcomes. As we navigate the complexities of the modern world, embracing the wisdom of crowds can lead to better decision-making and a higher likelihood of financial success.

April Showers…and Taxes

If it’s April, taxes are on the minds of most Americans. Based on decisions made throughout the prior calendar year, investors might be caught with a nasty tax surprise and need to write a large check to Uncle Sam. We consider your taxes daily to avoid these surprises at Hill Investment Group. Practices we implement, like tax loss harvesting and asset location (tax-inefficient asset classes in tax-deferred accounts), can meaningfully reduce the taxes an investor may owe annually. However, we are talking about one of the most impactful practices today: investing in ETFs rather than mutual funds.

ETFs and mutual funds are two types of investment vehicles and are simply different ways of holding a group of underlying securities like stocks or bonds. Most investment strategies can use either structure to execute their investment strategy. For example, Dimensional Fund Advisors and Avantis Investors, two companies we invest with, have both a mutual fund and an ETF for their US Small Value strategies. For each firm, the strategies are run the same way. However, they have a different legal structure that, in turn, has different tax consequences.

ETFs rarely distribute capital gains at the end of the year because of the way they rebalance and trade.

On the other hand, mutual funds almost always distribute some capital gains. The table below outlines the capital gain distributions for four specific funds in 2022.

| Vehicle | Ticker | Fund | Capital Gain Distribution (%) | Taxes Owed (%) |

| Fund | DFSVX | Dimensional US Small Cap Value Fund | 5.0% | 1.0% |

| ETF | DFSV | Dimensional US Small Cap Value ETF | 0.0% | 0.0% |

| Fund | AVUVX | Avantis US Small Cap Value Fund | 5.6% | 1.1% |

| ETF | AVUV | Avantis US Small Cap Value ETF | 0.0% | 0.0% |

Both the mutual funds distributed ~5% of their value in capital gains, whereas the ETFs did not distribute any. This means that investors in the mutual fund owed about 1% (assuming a 20% capital gains tax rate) in taxes to the government. For every $100,000 invested in the small value strategy, they owed $1,000 in taxes this April. Investors in the ETF, the same strategy but with a different legal structure, owed $0 in taxes this April.

By investing primarily in ETFs across our models, we avoid capital gain distributions for our clients in those funds and meaningfully reduce their tax bills yearly.

Let me know if you have questions or comments about this or any other investment-related topics by emailing me at: zenz@hillinvestmentgroup.com.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. Past performance is not indicative of future results.