Surrendering to the Speed of Reality

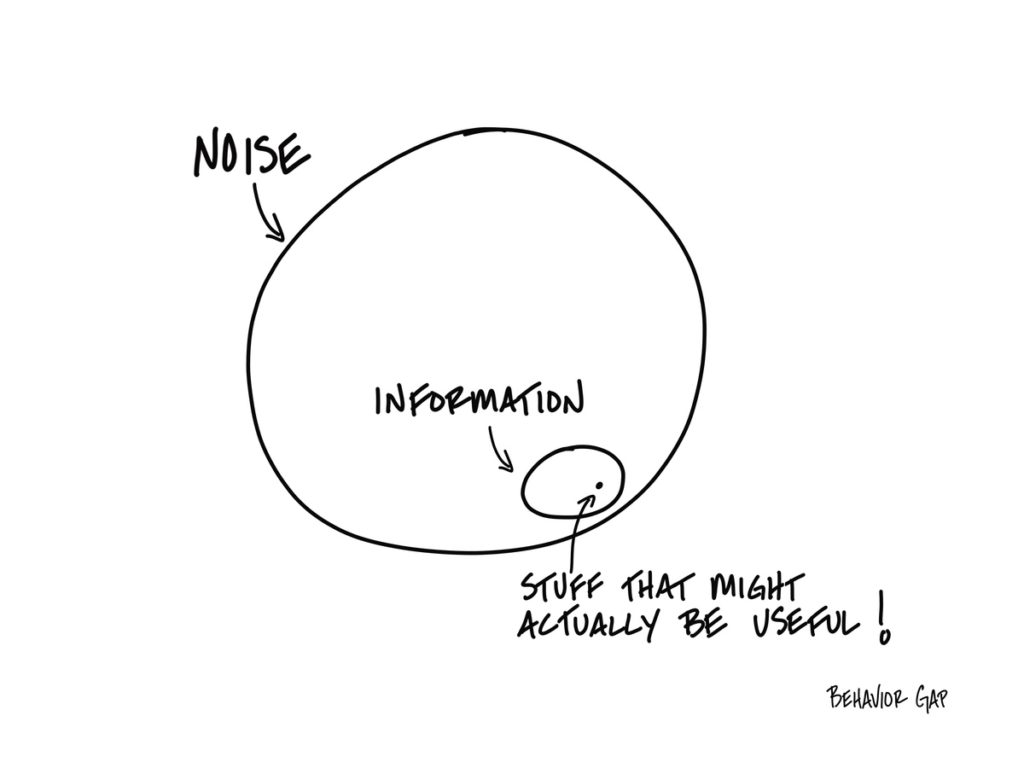

News outlets keep us informed which, in turn, gives us an intellectual edge over everybody else—so the theory goes. But what if the key to making better decisions was tuning out, rather than tuning in?

Maybe you’ve noticed this paradox: the more news you consume, the less informed you feel. That’s because news is, by definition, temporary. As soon as you form an opinion, a new headline comes along to cast doubt, and the cycle repeats.

This is especially true with financial news which plays on our fear of losing money, whether that’s missing the latest crypto trend or failing to hedge against inflation.

There’s a reason sensationalism goes viral. As Jason Gay noted in The Wall Street Journal, “Nobody gets clicks and famous for taking a long view; hell has to be served in a handbasket, preferably with a clever baiting headline.”

We’re not here to pick on financial writers; we’re here to point out how alarmist financial news chips away at our sanity. Finding and buying the latest hot stock offers an intoxicating thrill, like a lucky roll of the dice at a casino. But as a strategy to achieve long-term peace of mind, it’s doomed to fail.

Frantically refreshing your newsfeed to inform your investing strategy isn’t just inefficient, it’s exhausting. Human beings have a finite supply of mental energy, and trying to time the market day after day quickly zaps it. But once you get fed up with paying the biological (and monetary) price of attempting to outwit global capitalism, something clicks. At least it does for our clients who can take solace in the fact that they no longer have to pray that they uncover the needle in the haystack—they simply own the haystack…which already includes those needles!

In our world, we call this a “Long View Moment,” or as the writer, Oliver Burkeman says, “surrendering to the speed of reality.” It’s the sense of freedom when you realize that you don’t need to watch Squawk Box or jerk your head when you see a stock ticker.

When we let fantasies crumble (like the idea that you can “outsmart” the market), it clears the path for a new way of thinking where we embrace our limits instead of fighting them. Psychotherapists call this a “second-order change,” meaning it’s not just a behavioral tweak, but a change in perspective that reframes everything.

A change in perspective: that’s been the purpose of our newsletters, my podcast, and Hill Investment Group as a whole for years. We want to spread the word that building wealth doesn’t require tons of tiny decisions, but rather one big decision: to let go.

Once you abandon your attempt to manage the unmanageable, you can get to work on what really matters in life: spending time with loved ones, cultivating meaningful experiences, doing deep work.

Burkeman sums up this idea nicely in his book Four Thousand Weeks: Time Management for Mortals.

“When you finally face the truth that you can’t dictate how fast things go…you breathe a sigh of relief and begin to acquire what has become the least fashionable but perhaps most consequential superpower: patience.”