Play this Game

Timing the market can take on many different forms, but we’ve all done it at some point in our lives, even me. Sometimes the market is at an all-time high and we feel there is no way it can keep going up for much longer. We decide to wait for that market correction before investing. Sometimes there is turmoil in the world, markets are falling, and we want to wait to invest until that volatility subsides. In the moment, it always seems to feel obvious what the correct “market timing” strategy is.

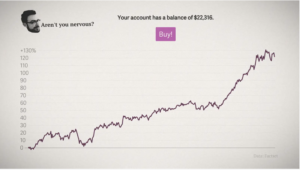

Unfortunately, in the real world, timing the market is extremely difficult to do. As a firm of investment professionals, we recently tried to artificially time the market during a team Zoom…and we failed miserably. We used the website: Try to Time the Market to test ourselves. The website simulates a random 10-year historical return sequence from the US stock market. Over those ten years, you get one chance to sell and go to cash, and one chance to buy back into the market. You will beat the market return if you pick the right time to get out and get back in. Sounds easy, just sell when the market is at a high, and buy when it’s at a low.

As a firm, we only outperformed the market 40% of the time. Meaning 60% of the time, we would have been better off if we had just stayed invested the entire 10-year period. To make matters worse, when we did beat the market, it was only by a few percentage points, but when we lost to the market, it was usually by 50+%.

The game only takes a minute to play. Give it a few tries, and see how you fair. We’d love to hear how you did.

Why did we fail at trying to time the market? On average, the market goes up a few hundredths of a percent every day. This means that each day your money is out of the market you are losing out on that potential gain. If the market actually went up a tiny bit every day, no one would ever think to try and time it. However, the volatility of the market makes trying to time it so enticing. If you just avoid some of those bad days, months, or years, it can make a drastic difference in your net wealth. The trouble is if you miss out on those great days, months, or years, it can also make a drastic difference in your net wealth. Given, on average, that the market goes up every day, you are better off not trying to play the timing game and simply stay invested.

You’re better off taking the long view.