Picking Up Pennies – Volume 7

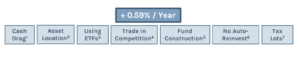

Welcome to the final installment of Picking Up Pennies. Last month, we discussed how understanding the concept of tax lots can optimize an investor’s tax consequences and even create a tax asset via active tax loss harvesting. Over the last six months, we have discussed different strategies we employ to increase returns, reduce costs, and minimize taxes. This final article will summarize the impact of these small decisions on your investment portfolio.

- Volume 1 – Keep Cash Balances Low (Better Chance for Higher Returns)

- Volume 2 – Asset Location (Reduces Taxes)

- Volume 3 – Using ETFs (Reduces Taxes)

- Volume 4 – Trading ETFs in Competition (Reduces Trading Costs)

- Volume 5 – Number of Funds and Not Auto-Reinvesting Dividends (Reduces Trading Costs)

- Volume 6 – Tax Lots and Tax Loss Harvesting (Reduces Taxes)

- Volume 7 – Summary (Total Impact)

Determining the exact impact of each decision is difficult as each strategy will impact every investor differently. For this analysis, we used what we think is a typical investor.

– Allocation is 60% Stocks and 40% Bonds

– Half of the money is in a taxable account, half is in an IRA

– Portfolio turnover is 10%/year

– 25% income tax rate, 15% capital gains tax rate

While the impact of some strategies may be more pronounced than others, it’s important to remember that every penny counts. When you add up all these strategies, you’ll see a significant difference in your investment outcomes. Specifically, about 0.59% per year or 59 basis points in financial industry jargon, which we prefer to avoid. Remember, all else being equal, the higher your tax rate, the more significant your net savings.

As discussed throughout the series, implementing these strategies is more than a one-size-fits-all approach. Each investor and family is unique, and tailoring these strategies to your needs takes time and effort. Our personalized approach is a testament to our commitment to your financial success.

In the first installment, I mentioned that I often ask other money managers how they implement these solutions. Most of the time, the response is, “We are not doing X because… it is too much work, clients don’t know the difference, the benefit is small, etc.” All of these answers are correct except one. It does take a lot of work…clients don’t normally notice the difference…but the benefit is NOT small. When you add all this up, it makes a meaningful difference. As your fiduciary, our obligation is to seek the best solutions we can find for our clients…no matter what.

These benefits are all the small details in your investment implementation. This series does not even include the bigger items that add even more value, like asset allocation, quarterly rebalancing, behavioral coaching, spending strategy, and a low-fee diversified investing strategy. Add it all together and compound these advantages over time, and now you’ve got something to be proud of now and in the long view!

1 Assumes the average investor holds 8% cash across uninvested cash and cash held in funds (5% + 3%). HIG holds 1% cash (0.7% + 0.3%). 60/40 portfolio returns 4% above cash. Impact = 30 bps

2 Assumes 5% bond returns and 10% equity returns. Impact = 20 bps

3 Assumes 3% annual capital gain distributions. Impact = 5 bps

4 Assumes savings of 2 cents per share traded. Impact = 1 bp

5 Assumes 20% additional fund turnover. 0.1% round-trip trading costs. Impact = 2 bps

6 Assumes 4% distributions and 0.1% higher trading costs. Impact = 1 bp

7 Tax benefits would depend on specific market conditions. Impact assumed to be zero for this analysis.