Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: A piece we love

A Quote We Love – Smart and Patient Wins Again

Podcast guest and personal finance author Morgan Housel recently wrote a piece warning of the dangers of trying to take the “fast” approach to investing. Housel’s “Too Much, Too Soon, Too Fast” tells the story of what happened to the third, lesser-known, investing partner of Warren Buffett and Charlie Munger.

Here’s an excerpt:

Everyone knows the investing duo of Warren Buffett and Charlie Munger. But 40 years ago, there was a third member, Rick Guerin. The three made investments together. Then Rick kind of disappeared while Warren and Charlie became the most famous investors of all time.

A few years ago, hedge fund manager Mohnish Pabrai asked Buffett what happened. Rick, Buffett explained, was highly leveraged and got hit with margin calls in the 1970s bear market.

Buffett told Pabrai:

Investing at the Top – A Forbes Piece We Love

John Jennings, podcast guest, Chief Strategist, and President at The St. Louis Trust Company, recently wrote about why it’s okay to invest at the top of the market in his latest Forbes piece. He shares the story of two clients, one that took his advice and one that didn’t. Which client are you…Smith or Jones? Read the outcome here.

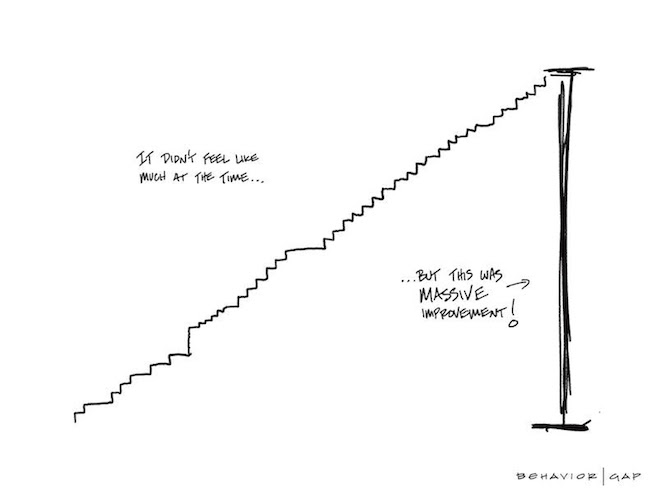

The Magic of Incremental Change

HIG friend, podcast guest, and NYT columnist, Carl Richards, shared the following story about how incremental change adds up if you take the long view. Keep reading for the story behind the sketch.

The Magic of Incremental Change

Back when I lived in Las Vegas, I used to ride road bikes with a semi-competitive group of riders. I remember when I first joined the group, it felt like a big victory if I could just keep up with them for the first 15 minutes. After a while, that became the first half-hour. Then an hour. One day, almost without even noticing it, I was suddenly able to stick with the pack for the entire ride.

It felt sudden at the time, but of course, it wasn’t. And although I was surprised, nobody else was, because they had all seen it before with other riders or experienced it themselves.

This is the sneaky power of incremental change.

Each day, you make a small improvement. Then, that becomes the new normal, and you get used to it. You make a small improvement again, and then that becomes the new normal. This happens over and over, slowly but surely. We barely notice we are getting closer to our goal, and then (again, seemingly “all of a sudden”) we’re there!

I didn’t feel a lot faster because I wasn’t a lot faster… compared to yesterday or even last week. In fact, I was just a little faster than I was last month. But month after month, ride after ride, it all added up. All those little bits of “faster” started to compound on top of one another.

Of course, this doesn’t just apply to riding bikes. I’ve had times in my career where I wondered if I was accomplishing anything. I specifically recall a time when I was working remotely for a large company. I got very little feedback on my work and was largely left alone. I loved the independence, but I also struggled because I had no idea if what I was doing was valued by the people I worked for.

To deal with this struggle, I started reviewing each week and noting what I had done. It felt weird at first because I didn’t want it to be seen as taking credit for things, but as the weeks added up and the list got longer, it felt good. I was doing stuff, and that stuff was making a difference, for sure.

No one else needed to see the list. It still felt good. It helped me to see, in real-time, how incremental changes add up.

If you build a process of reflecting every quarter, month, and year, you’ll never feel like you’re not accomplishing anything again. And while that may spoil some of the surprise of suddenly and unexpectedly arriving at your goal one day, I promise it will be worth it to feel much better along the way.

-Carl Richards