Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Education

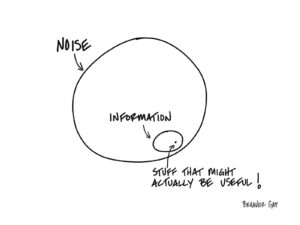

Noise Info Wisdom

Do me a favor.

Try to remember a time when you read or heard something about money in the news, you acted on it, and then, with the benefit of hindsight, you were glad you did.

This could include any number of things: the latest IPO, bear markets, bull markets, mergers, market collapses.

Go ahead, I’ll wait. Close your eyes and think about it.

I’ve done this experiment hundreds of times around the world, and I’ve only had one person come up with a valid example. It was news about a change in the tax law.

That’s it.

Isn’t that interesting?

Think of all the financial pornography out there, think of all the dental offices that have CNBC playing in the background, think of the USA Today Money section. Almost all of it is noise. Almost none of it is actionable.

Sure, every once in a while, there is this little teeny tiny speck of information that might be useful. But you sure have to wade through a lot of garbage to get to it.

This leads to one obvious question: Why are we paying attention to the noise in the first place?

It might be fun, if you’re into that kind of thing. You know, like going to the circus. But most likely, it’s just a waste of time.

What if, instead of obsessing over the news, you used that time to work on that list you have…

You know, “The List.” The one that has all the really important things you actually want to do with your time.

Doesn’t that sound so much better than spending another hour watching the news?

Aligning Your Health and Investing Plans

I’m a long-time fan and follower of both Dr. Peter Attia, a Stanford and John Hopkins-trained physician focused on “healthspan,” and the investment philosophy of David Booth, Co-Founder and Chairman of Dimensional, our core investment partner. Both Attia and Booth espouse our “take the long view” philosophy that is at the core of what we, and our clients, believe is the optimal path forward. That’s great news…because the longer you live, the more important it is to have an investment plan and portfolio that outlives you, and hopefully those you love. Enjoy David Booth’s 1-pager on the parallels between these two important plans and how they apply to your own life, including:

- No one-size-fits-all solution,

- No quick fixes, i.e., “take the long view” and

- It is better to prevent problems rather than fix them later.

5 Tips for a Winning Financial Planning Session

Have you ever sat in your car in the parking lot after visiting the doctor for your annual physical and said to yourself, “Oh, I forgot to ask the doctor about X…Now it’s too late”?

Have you ever sat in your car in the parking lot after visiting the doctor for your annual physical and said to yourself, “Oh, I forgot to ask the doctor about X…Now it’s too late”?

We’ve all had those moments where more formal preparation would have made our meetings with doctors, lawyers, contractors, etc., more productive and valuable. Meeting with your financial advisor is no different. Preparation before your regular review can help you and the advisor. Here are five basic steps to help you prepare for the next meeting with your Hill client service advisor.

| ACTION STEP | WHY IT’S IMPORTANT | |

| 1 | Clear out other distractions before your meeting. | You are busy with a personal and professional life. But your review meeting is important, and you want to resist the urge to “squeeze it in.” Holding the meeting when all parties are mentally present is critical. Don’t hesitate to change the meeting date if need be. |

| 2 | Review the summary and actions from the last time you met with us. | This will help jog your memory. Your meetings should have continuity without that feeling of starting over. |

| 3 | Reflect on any changes in your family, priorities, spending, employment, and key milestones/events during the past year and ones that you already know will occur in the future. | Your financial plan is unique to you and your family. Sound advice depends upon a context – your life. The more Hill knows about your situation, the more tailored and thoughtful the conversation will be. |

| 4 | Review the agenda sent before the meeting and suggest additions or mark up with your notes. | Your review meeting is for you, and the agenda should reflect your priorities. This will ensure your time is focused on topics that are vital to you and your family. |

| 5 | Draft and bring along any questions and topics you’d like to hear more about. | Formally writing down questions ensures you don’t leave the meeting with that lingering question or topic. |

Years ago, when I taught leadership classes, one of my favorite quotes was from the Tanzanian marathoner Juma Ikangaa, who said, “The will to win means nothing without the will to prepare.” Okay, your financial review may not require the same sacrifice as training for a marathon, but taking these five steps can make you feel like your next review is a real win for you and your family.