Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Philosophy

New Year. Same Markets. Better Media Diet.

If you want a resolution that will actually help your investing life in 2026, start here: clean up your media diet.

Not because we’re suggesting you avoid reality or pretend the world is calm. We mean something more practical: be ruthless about who gets access to your attention and what they’re trying to do with it.

Most financial media isn’t designed to help you invest well. It’s designed to keep you watching. So…

Everything is urgent.

Everything is breaking.

Everything is either a bubble or a collapse.

And the “right move” is always: stay tuned.

Your long view plan runs on a different fuel. It’s built on evidence, diversification, and the actual life you’re trying to fund. It’s built on what lasts, not what trends.

The best long view investors are not the ones consuming the most content. They are the ones protecting their attention, staying consistent, and making changes only when the facts change.

A simple filter for 2026:

Before you read or watch anything money-related, ask:

“How is the author trying to make me feel?”

If the answer is “anxious,” close the tab. Move on.

Attention is a financial asset. Treat it like one.

Hill Investment Group Partners, LLC (HIG) is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information in this publication is for educational and informational purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any specific securities, investments, or investment strategies. Nothing contained herein should be construed as individualized investment, tax, or financial advice. Always consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed.

Investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Future returns may differ significantly from past returns due to market and economic conditions, among other factors.

Larry Swedroe on the Excess Returns Podcast

We’re grateful to have Larry Swedroe as both a longtime friend to Hill Investment Group and a foundational voice in the evidence-based investing community. For decades, Larry has helped investors cut through noise, resist prediction-driven thinking, and stay anchored in the data – an approach that has shaped our work and benefited the clients we serve.

In his latest appearance on the October 22nd Excess Returns podcast (the same show our CIO, Matt Zenz, joined recently), Larry brings that perspective to today’s big conversations around tariffs, immigration, AI, and market structure.

“HTC” WARNING: Be forewarned, this is Highly Technical Content, best consumed by the heavy-duty fact finders in our audience and to all those who want to take a deeper dive into why we believe what we believe.

If you only have a few minutes…

Jump to 33:05, where Larry explains why smaller, more nimble funds can access deeper exposures in areas like small-cap value – an insight that reinforces one of the key advantages of our own approach to managing The Longview Advantage ETF (EBI).

It’s a thoughtful, wide-ranging conversation, and we’re thankful for Larry’s ongoing partnership and the clarity he brings to evidence-based investing.

Culture & Perspective: Why Culture Matters

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

The Hill perspective is well known. It is our motto and our compass: Take the Long View. Many of our clients and friends of the firm also know our culture. We strive to be warm, caring, thoughtful, serious about our work, and human enough to enjoy it together.

As we grow, an important question stays front and center: how do we continue to deepen both our culture and our perspective at the same time, especially as our team is spread across the country?

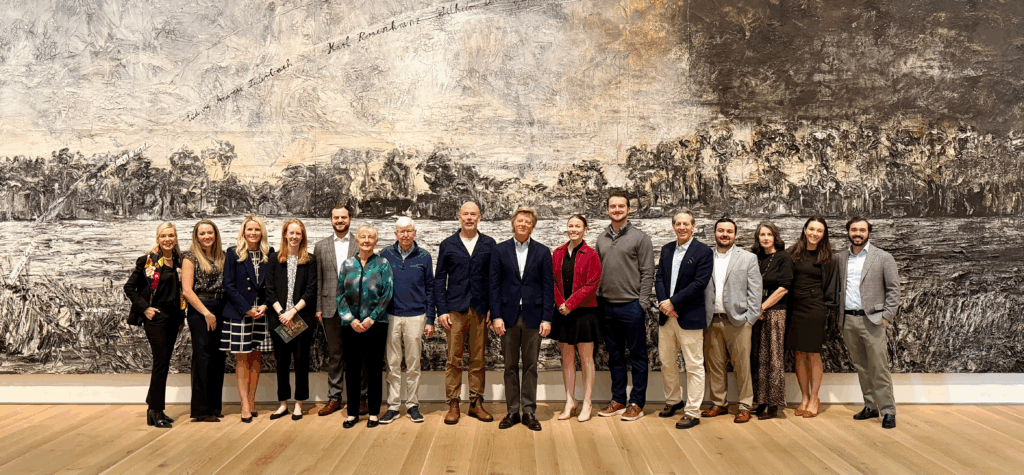

Occasionally, we’re given a rare gift: the chance to be together in one place. Last month, nearly our entire nationwide team happened to be in St. Louis at the same time. Recognizing how uncommon that is, we chose to be intentional with the moment and invest it in something meaningful.

When author, artist, and former financial advisor Carl Richards was in town for our event, we extended the experience by taking the team to a once-in-a-lifetime exhibition by German artist Anselm Kiefer at the Saint Louis Art Museum. The visit was arranged by my wife, Jeana, who serves in a volunteer leadership role at the museum. Notably, Jeana and Rex Sinquefield, co-founder of Dimensional Fund Advisors, were among the significant underwriters supporting the exhibition.

Together, we spent time immersed in the work of one of the most important living contemporary artists. Kiefer, who recently turned 80, is known for confronting history, destruction, and renewal on a monumental scale. His work takes the long view. From loss comes rebirth. From devastation, renewal. The physical scale of his art reinforces the message. Some things simply cannot be understood without stepping back and taking them in fully.

It is hard not to see the parallel.

Life is not smooth. Markets are not either. Both move in cycles that include setbacks, uncertainty, and moments that test conviction. Yet over time, periods of decline have been followed by recovery. Often the most meaningful progress comes from staying engaged rather than stepping away when things feel uncomfortable.

Clients often tell us that one of the most valuable things we do is help them stay on the ride. Not because there are guarantees. There are not. But because perspective matters. When you zoom out and look across decades rather than days, the long-term story of investing has been one of resilience and growth.

That perspective is deeply embedded in our culture. It shapes how we invest, how we advise, and how we support clients through both calm and turbulent moments.

Hill Investment Group is only 20 years old, but we are grounded in values and relationships that allow us to do our work with care, humility, and conviction. When we have moments to come together as a team, we try to use them intentionally to reinforce who we are and how we think.

We’re grateful to share this journey with you, and we look forward to continuing the ride together.

Happy Holidays.