Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Philosophy

Signal vs. Noise: The Lakers, the Stock Market, and the Power of Clear Thinking

Welcome to the age of the “finfluencer.” While some have genuine experience, many are focused on views, and not your best interest. At Hill Investment Group, we believe that real advice should be simple, clear, and grounded in evidence, not hype. That’s why we’re launching a new series to unpack misleading ideas that circulate online or in print.

Our goal? To inform, not entertain. To offer substance, not speculation.

Heard something at work, at golf, or on social media that has you asking, “Should I be paying attention to this?” Feel free to share it with us. We’d love to help unpack it. Submissions will remain confidential unless we get your permission to share anonymously. Send to: zenz@hillinvestmentgroup.com

Please note: Submissions are reviewed for educational purposes only and do not constitute personalized investment advice.

A prominent advisor at a national wealth management firm recently posted a popular headline online:

“What could possibly have performed better than buying the Lakers for $67.5 million in 1979 and selling them for $10 billion today?

Answer: The stock market.”

The post argued that simply investing in the S&P 500 would have outperformed the sale of the Lakers by an estimated $3.7 billion.

It’s catchy. And it seems to reinforce a message we strongly believe in: that long-term, diversified investing often outperforms more exciting-sounding alternatives.

But there’s a problem: the comparison isn’t accurate.

The claim uses the total return of the S&P 500 (which includes both price appreciation and reinvested dividends) but compares it to only the price appreciation of the Lakers. That’s not an apples-to-apples comparison.

To make a fair comparison, we’d need to include decades of Lakers’ profits, as well as proceeds from the sale of other assets tied to the original deal, like the L.A. Kings, The Forum, and other valuable land holdings. A more appropriate benchmark for the S&P 500 would be its price return alone, which would have resulted in a significantly smaller figure than the Lakers’ current estimated value.

It’s like evaluating a stock without considering the dividends. As evidence-based investors, we know how important it is to look at the full picture.

Why Total Return Matters

At Hill, we focus on total return—not just income or price growth—because it reflects the complete investment outcome. Ignoring part of the return can lead to faulty comparisons and poor financial decisions.

So let’s not lose sight of the broader point: Owning a low-cost, globally diversified portfolio has been one of the most accessible and consistent wealth-building tools for long-term investors. Unlike a professional sports team, which typically requires billions in capital, an evidence-based portfolio is available to nearly anyone with savings and discipline.

Yes, buying the Lakers was a great investment for Jerry Buss.

But for the rest of us? Trusting markets, managing costs, and sticking to a thoughtful plan…that’s a powerful approach, too.

This example is for illustrative purposes only and does not reflect the performance of any specific investment or portfolio. Index performance is not indicative of any particular investment. It is not possible to invest directly in an index. Past performance does not guarantee future results.

More Long View, More Long Term Success

Tune Out the Noise. Stay the Course.

We’re more plugged in than ever. The average person now spends nearly four hours on their smartphone daily, and over half of Americans get their news from social media. That’s a lot of headlines, and most of them short, urgent, and emotionally charged.

While access to information has never been greater, trying to beat the market by reacting to it is one of the surest ways to undermine your financial progress.

This constant stream of information can rattle even disciplined investors. Markets dip on geopolitical tensions. Another AI company announces a breakthrough. Interest rates nudge higher. The instinct is to react, shift allocations, “de-risk,” or step out of the market altogether.

But history shows that these short-term decisions often hurt long-term results.

Explore the Research

Independent research backs this up. Morningstar’s Mind the Gap study, most recently updated in 2023, compares the returns of investment funds to the returns earned by the investors in those funds. The results reveal a persistent gap: investors tend to underperform their own investments by 1.0% to 1.7% annually. Why? Because they often buy high, sell low, and attempt to time the market, frequently in response to short-term news.*

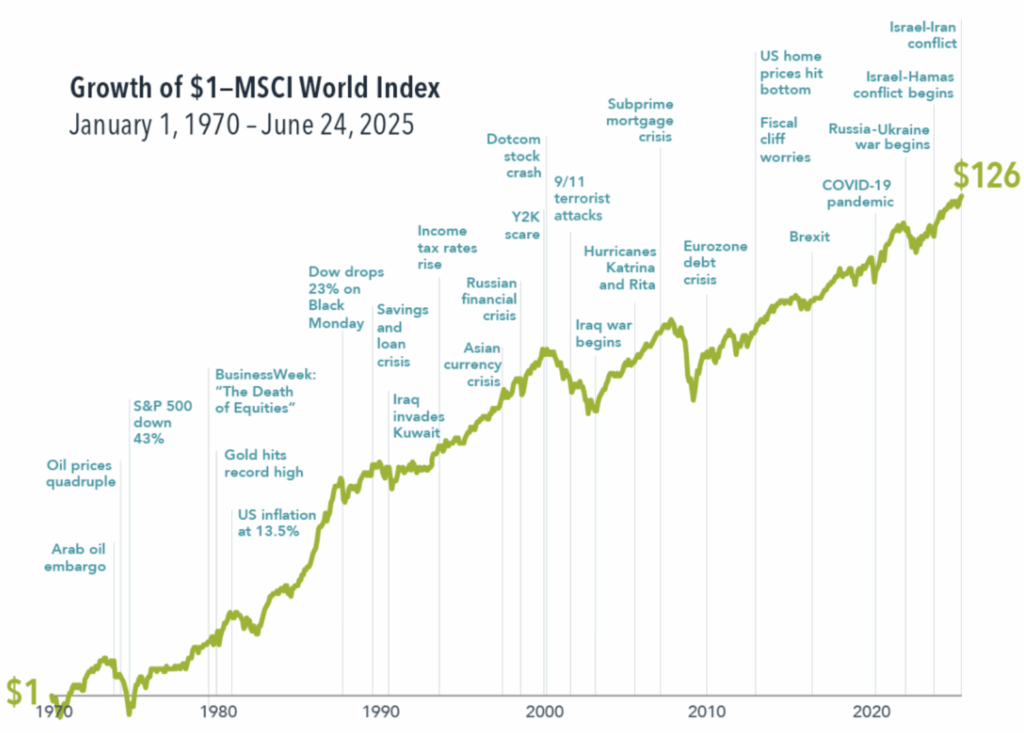

Consider this hypothetical example: Over the last 50 years (1974–2023), while markets faced double-digit inflation, multiple financial crises, and a global pandemic, long-term investors who stayed disciplined were rewarded. A $1 investment in the MSCI World Index would have grown to approximately $126.** Now imagine an investor who underperformed that index by just 1% annually; they would have ended up with a portfolio roughly 40% smaller.

What We Focus On

At Hill Investment Group, we work to tune out short-term noise, not because we’re ignoring reality, but because we believe markets are constantly processing new information. The headlines you’re reading? The market read them about five seconds ago. By the time most investors can react, they’re already behind.

Taking the Long View means focusing on what can actually be controlled: strategic asset allocation, disciplined rebalancing, thoughtful tax management, and investor behavior. That’s where meaningful long-term impact happens.

When headlines get loud, remember this: staying invested is not a passive decision. It’s an active commitment to your plan. That’s what we help our clients do every day.

That’s The Long View.

* Morningstar (2023): Mind the Gap Study – U.S. Edition

** Dimensional Fund Advisors (2025): Geopolitical Jitters

Hey, Hill: Should I Consider a Roth Conversion?

At Hill Investment Group, we’ve found that when a few clients ask similar questions, many more are likely thinking the same thing. To better serve you, we’re introducing our “Hey Hill” newsletter series—addressing common client questions and sharing our perspective.

To submit a question for a future post, email us at service@hillinvestmentgroup.com

Is a Roth IRA Conversion Right for You?

Roth IRA conversions can be a valuable, but often misunderstood tool in long-term financial planning. When thoughtfully timed and executed, they may provide tax advantages, increased flexibility, and legacy planning benefits. But like most financial strategies, they’re not one-size-fits-all.

So how do you know if a Roth conversion might make sense for your situation?

What Is a Roth Conversion?

A Roth IRA conversion means moving money from a pre-tax retirement account—such as a Traditional IRA—into a Roth IRA. You’ll pay ordinary income taxes on the converted amount in the year of the transfer. From that point forward:

- Your investments may grow tax-free inside the Roth

- You can make tax-free withdrawals in retirement (if IRS rules are followed)

In essence, you’re trading a tax bill today for the potential of tax-free growth and withdrawals in the future.

Who Might Want to Consider a Conversion?

A Roth conversion may be worth exploring if:

- You expect to be in a higher tax bracket later

- You can pay the tax bill from non-retirement assets, leaving your retirement funds intact

- You’re in a temporarily low-income year (e.g., early retirement, career break, or sabbatical)

- You’re planning for heirs—Roth IRAs aren’t subject to required minimum distributions (RMDs), which may make them attractive in legacy planning

- You don’t need the money soon—the longer Roth funds grow tax-free, the more powerful the benefit

How It Can Support Your Long-Term Plan

When aligned with your overall strategy, a Roth conversion can:

- Reduce future RMDs and lower taxable income in retirement

- Diversify your tax “buckets,” giving you flexibility in how you draw income

- Potentially ease your heirs’ future tax burden by leaving them tax-advantaged assets

- Help you build more predictable after-tax income over time

It’s a classic example of playing the long game—something we believe in deeply at Hill.

When It Might Not Make Sense

A Roth conversion isn’t ideal for everyone. It may not be the right move if:

- You’d need to use retirement funds to pay the conversion tax

- You’re already in a high tax bracket and expect it to be lower in the future

- You’ll need access to the converted funds within five years (each conversion starts a separate 5-year clock for penalty-free withdrawals)

The Bottom Line

Roth conversions can be powerful, but the decision is nuanced. The tax rules are complex. The upfront cost can be significant. And timing matters.

That’s where we come in. Through our advisory relationships, we help clients model the long-term impact of a Roth conversion—year by year—so they can move forward with clarity and confidence.

At Hill, we don’t just focus on what’s smart today. We help you make decisions that align with your long-term goals and legacy.

Thinking about a Roth conversion? Let’s explore whether it’s a fit—for your plan, your family, and your future.

Disclosures:

Hill Investment Group is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. The information provided is for educational purposes only and should not be construed as personalized investment, tax, or legal advice. Roth IRA conversions involve complex tax considerations and may not be appropriate for all investors. Consult your tax advisor or financial professional before implementing any financial strategy. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results.