Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Planning

The Big Picture: Integrating all of your Assets at Hill

Integrating Your 401(k) into your Financial Plan

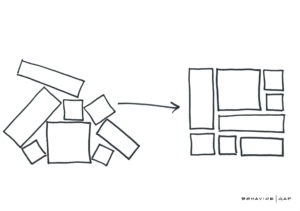

To have the best and most accurate picture of your financial situation, you must look at every asset (and liability). Did you know that you can integrate your 401(k), 403(b), 457, HSA, and variable annuity accounts into your overall plan? And get help managing the investments directly?

We have a new state-of-the-art system that allows for safe and compliant HIG advisor access to all of your accounts – taking the hassle, fiduciary responsibility, and management risk off your plate.

What does this mean for me?

- HIG taking fiduciary responsibility – upon setup, HIG takes on immediate responsibility for managing these assets.

- Combatting volatility with timely trading and rebalancing – ensuring your allocation is in line with your plan, no matter what’s happening in the markets.

- Investing in the right funds for you – full review of the cost and quality of available funds immediately upon setup, repeated quarterly.

- Tax efficiency through asset location – maximizing the value of these vehicles as an important part of your portfolio.

- Cost – the cost for this service is determined according to your regular fee schedule. See more details here.

Why it matters

These accounts shouldn’t be an orphaned part of your financial picture. Let us coach you more effectively and get the peace of mind knowing ALL of your assets are taken care of, no matter what.

Ready to set up your access to this service?

Schedule a call with me here. Setup takes no more than 15 minutes.

The Defining Decade

As HIG’s “client concierge,” I’m often asked about what books I would recommend for younger investors or those new to investing. Two obvious ones have been written about here before: The Psychology of Money by Morgan Housel and Odds On by Matt Hall.

As a concierge, though, after answering the question initially asked, I like to add to an important question that may not have been asked. In this case, “What book would you recommend to my 20-something (child, grandchild, niece, nephew, godchild, etc.) about life and career?” The title that tops my short list is unequivocally, The Defining Decade: Why your twenties matter and how to make the most of them now, by Meg Jay, Ph. D.

While the clear and direct audience is the 20-something, parents, grandparents, and others can also benefit from reading the title. Meg Jay provides an outstanding framework to hold productive conversations with anyone, especially twenty-somethings, based on her years as a clinical psychologist specializing in adult development. Not surprisingly, for our regular readers, Dr. Jay brings plenty of data and evidence along with her anecdotes.

As a parent of three kids in their twenties, I thought it was a great time to revisit this title myself. Fortunately, my wife, Jeana, encouraged our kids to read the book while in high school or college. As all three embark on new careers or career changes, I’m forever grateful to her for discovering this title years ago. Notably, an “updated” 2021 edition provides additional data and evidence since the 2012 original publication.

If you would like to receive a complimentary copy of the book or discuss the topic further, call me at 855-414-5500.

Effective and Efficient Charitable Giving

Numerous studies have tried to measure the psychological benefits of giving to others. Whether giving to another person or organization or helping a friend with a project, the donor’s psychological benefits are typically even more significant than the recipients. In that light, let’s discuss three of the most common ways to give money to various charitable organizations and their respective benefits.

Cash: The most common method is to write a check from one’s checking or investment account. Then, you accumulate all of your documentation of charitable giving throughout the year, and you may get a tax deduction. We say “may” because you will only receive a tax deduction for your charitable giving if all your itemized deductions exceed the standard deduction.

Qualified Charitable Distribution: Another option is to make a charitable contribution directly from your IRA. This option is only available for those over 70.5, and the maximum amount is $100k/year. There is no tax on the IRA withdrawal and no deduction on the tax return. This option is attractive for those whose standard deduction is larger than one’s total individual deductions.

Additionally, for those 72 and older, the withdrawal from their IRA will count toward their required minimum distribution for that year. Not having the full required minimum distribution amount count as income will lower one’s taxable income, which may have other benefits such as lower the Medicare surcharge on Social Security.

Donor-Advised Fund: A third option is to establish a Donor Advised Fund (DAF) and contribute taxable assets to the fund that will supply several years of future donations (we suggest 5-10 years of one’s annual contributions). We typically recommend clients contribute appreciated securities that they have held for over one year to the fund to avoid realizing the gain on the position. You will take a tax deduction within the year you fund your DAF. You can make contributions at any point in the future or bequeath the fund to specific organizations at your death. There is no additional tax deduction when you grant the money to charities, and there is no need to track the donations. Additionally, because the money inside the fund is invested, it can continue to grow and allow you to give more to charitable organizations that are important to you.

These are just three of the many ways to give to charitable organizations important to you. For more information on methods of charitable giving please reach out to us.