Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: Evidence-Based Investing

Image of the Month

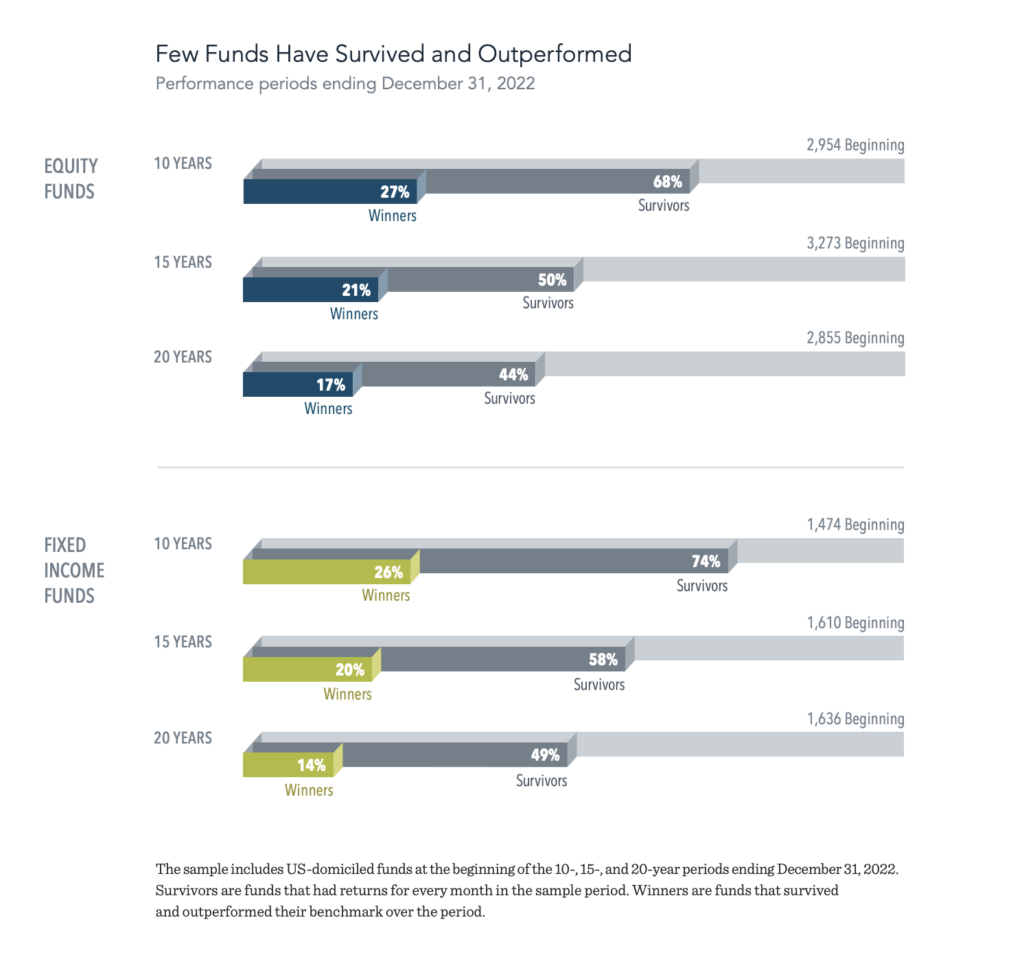

Each year, Dimensional analyzes investment returns from a large sample of US-domiciled funds (over 4,000). This year’s study updates results through 2022 and includes returns from mutual funds and exchange-traded funds (ETFs) domiciled in the US. The evidence shows that a majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. We believe that the results of this research provide a strong case for relying on market prices when making investment decisions.

The One Minute Audio Clip You Need to Hear

Howard Marks is a very successful writer, speaker, thinker, and money manager. He is Co-Chair of Oaktree; you can read his impressive bio here.

We think you need to hear this clip because it is one of the better examples of all time, in our humble opinion, illustrating why taking the long view is likely the winning approach.

There is no need to swing for the fences to be a successful investor. It’s actually the opposite.

Enjoy this classic clip from Howard Marks’ interview with Barry Ritholtz on Bloomberg’s Masters In Business from 2019.

*If you want the full interview, you can find it here.

New Video: Evidence-Based Philosophy

Get the essence of what it means to be an evidence-based investor in our newest three-minute video.