Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Tag: philosophy

Backstage Values Frontstage

Corporate values are often empty. They are usually statements glued to walls or made into stickers. Rarely are company values meaningful enough that people remember them and feel a connection. At Hill Investment Group, we try to live our values in an understated fashion, preferring not to melt them onto a T-shirt but to live them. Please enjoy the six statements below as we share our backstage values in a front-stage fashion.

MAKING FRIENDS IS OUR BUSINESS

Inspired by the old Anheuser-Busch mantra, relationships are at the heart of what we do. Sometimes, friends become clients, and often, clients develop genuine connections with our team. “There will be neither frustration nor failure where there is friendship.”

CHEERS AND THE FOUR SEASONS

Hill Investment Group is a place where we truly know our clients. We know what they like to drink and the preferences that make them who they are. We see clients and serve them in a manner befitting a familiar and high-end experience. We value hospitality, reliability, and excellence.

PATIENCE AND DISCIPLINE

The rewards of the long view are only possible if we can help our firm and clients focus on what truly matters.

CANDOR

We value the truth (no spin) and commit to giving it to one another and our clients, both when it’s easy and hard.

EVIDENCE-BASED INVESTING EVANGELISTS

We don’t choose gunslingers and gurus to manage the real wealth of clients. We favor repeatable, reliable, robust forms of investment returns.

FUN GOES WITH BUSINESS

We take our work seriously and have fun in the process! We celebrate our wins and recognize life and work milestones at every chance.

Movie Time

I invite you to watch an enlightening movie with me if you’re in STL on October 5th! Originally intended as an event for our firm’s clients, we decided that we wanted to share it with others and are saving a select group of seats for friends of our firm. The 88-minute documentary on the characters who changed modern finance for the better will leave you feeling smarter and more connected to the truth of successful investing. An Academy Award-winning documentarian made the film, and it is appropriately titled Tune Out the Noise. Watch the trailer and sign up here if you’d like to enjoy it with us at the spectacular Saint Louis Art Museum Farrell Auditorium.

*If you’re not in St. Louis, let us know if you’d like information on future screenings in additional cities by emailing us here.

More reasons to attend:

- Co-CEO Dave Butler will be live in attendance for a Q&A following the movie.

- This is the first film to tackle the academic, business, and practical themes connected to modern investing.

- Tune Out the Noise has yet to be publicly available.

- The Art in the film is, in many ways, its own story.

- The score is composed by the award-winning Paul Leonard-Morgan.

- During the “back to school” season, this is an excellent way to fulfill your lifelong learning commitment.

Broken Clocks are Right Twice a Day

Does anyone know when to get in and out of the market? Many professionals try, and we’ve heard a few theories from amateur investors lately. It’s tricky to tell fact from fiction. There are a million ways to analyze historical data to find timing patterns that appear to produce attractive returns. The real question you need to ask yourself: “Is there any reason why I should expect that pattern to continue in the future, or is it purely due to chance?”

An example. Over the last thirty years, if you sorted stocks based on the letter of the alphabet they started with, you would see that stocks that began with the letter “M” outperformed those that started with the letter “E.” Is there any reason to suspect this to continue over the next 30 years?

No, clearly, the letter of the alphabet should have no impact on a company’s returns. The reason for this difference is that Microsoft was a large, successful company over this period, while Enron was a large, unsuccessful company over this period.

When working with “noisy” data, the odds that the results are evenly distributed is very small. If you roll a die six times, the odds of getting each number exactly once is tiny (1.5%). That means there is a 98.5% chance you will roll some number two or more times and some number zero times.

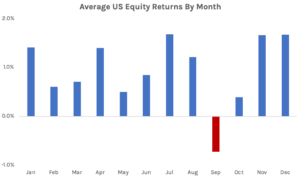

A typical market timing strategy we hear about around this time of year is to “avoid investing in the month of September.” At first thought, it seems odd that September would produce below-average returns, but when you look at the historical data, it is true!

Is there any economic rationale as to why this should continue in the future? I can’t think of any. Some claim that it is due to market participants selling positions to clean up their books after taking time off in the summer. If that were true, why wouldn’t investors try and get ahead of it and sell in August? Or why wouldn’t hedge funds gobble up all the low-priced stocks and keep prices stable?

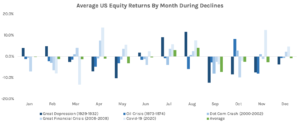

Let’s dive deeper into the data and look at the five largest market declines over the last 100 years. Each drop produced several months of negative returns, but all five of them spanned September at some point.

The recession peaked in different months every time, and every month was hit negatively at some point. However, there was bound to be one month affected more than others. It just happened to be September. From 1926 to 2021, 52% of the September months had positive returns. The large negative returns from a few market downturns have skewed the average to be negative. The question is, do we expect this to continue in the future?

Whenever you hear of these market timing strategies, you need to ask yourself if there is a logical economic rationale as to why the trend existed in the past and why it should continue in the future. Is there some risk associated with September we don’t know about? Is there some behavioral rationale that investors can’t arbitrage away? If you can’t come up with a concrete reason, whatever anomaly you are looking at is most likely due to chance and not a reliable trading strategy to implement in the future. Before accepting any investment truism, it is important to be sufficiently skeptical before implementing it yourself.

Returns from Fama/French CRSP Data Library.