Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Education

More Long View, More Long Term Success

Tune Out the Noise. Stay the Course.

We’re more plugged in than ever. The average person now spends nearly four hours on their smartphone daily, and over half of Americans get their news from social media. That’s a lot of headlines, and most of them short, urgent, and emotionally charged.

While access to information has never been greater, trying to beat the market by reacting to it is one of the surest ways to undermine your financial progress.

This constant stream of information can rattle even disciplined investors. Markets dip on geopolitical tensions. Another AI company announces a breakthrough. Interest rates nudge higher. The instinct is to react, shift allocations, “de-risk,” or step out of the market altogether.

But history shows that these short-term decisions often hurt long-term results.

Explore the Research

Independent research backs this up. Morningstar’s Mind the Gap study, most recently updated in 2023, compares the returns of investment funds to the returns earned by the investors in those funds. The results reveal a persistent gap: investors tend to underperform their own investments by 1.0% to 1.7% annually. Why? Because they often buy high, sell low, and attempt to time the market, frequently in response to short-term news.*

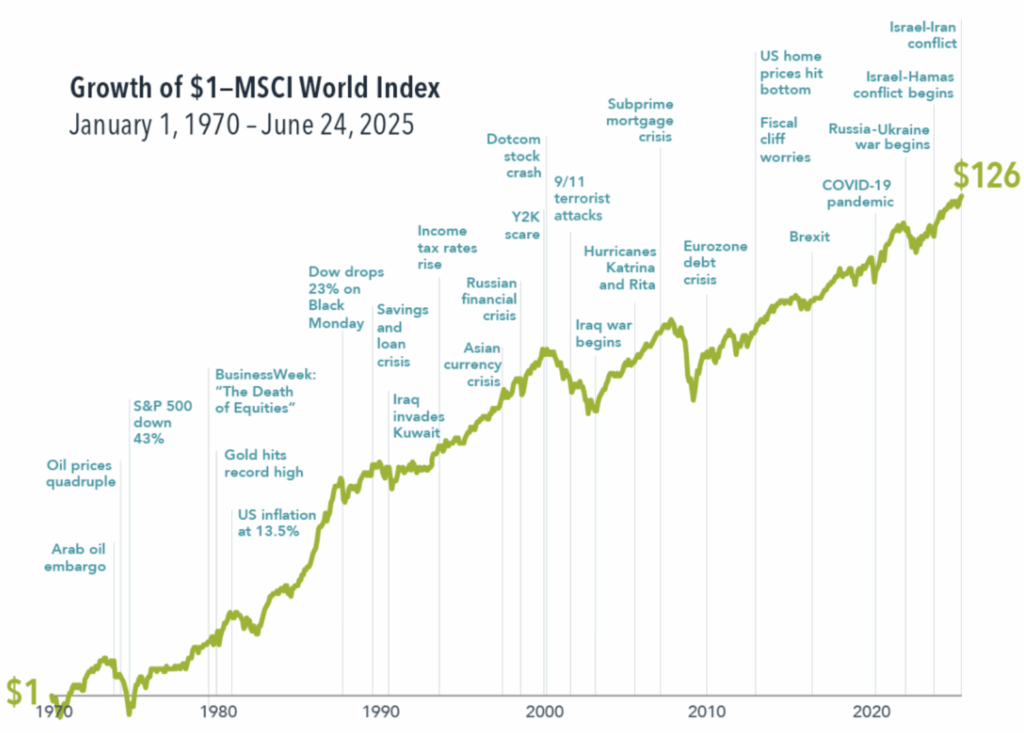

Consider this hypothetical example: Over the last 50 years (1974–2023), while markets faced double-digit inflation, multiple financial crises, and a global pandemic, long-term investors who stayed disciplined were rewarded. A $1 investment in the MSCI World Index would have grown to approximately $126.** Now imagine an investor who underperformed that index by just 1% annually; they would have ended up with a portfolio roughly 40% smaller.

What We Focus On

At Hill Investment Group, we work to tune out short-term noise, not because we’re ignoring reality, but because we believe markets are constantly processing new information. The headlines you’re reading? The market read them about five seconds ago. By the time most investors can react, they’re already behind.

Taking the Long View means focusing on what can actually be controlled: strategic asset allocation, disciplined rebalancing, thoughtful tax management, and investor behavior. That’s where meaningful long-term impact happens.

When headlines get loud, remember this: staying invested is not a passive decision. It’s an active commitment to your plan. That’s what we help our clients do every day.

That’s The Long View.

* Morningstar (2023): Mind the Gap Study – U.S. Edition

** Dimensional Fund Advisors (2025): Geopolitical Jitters

Hey Hill! How Do I Protect Myself in the Digital Age?

At Hill Investment Group, we’ve found that when a few clients ask similar questions, many more are likely thinking the same thing. To better serve you, we’re introducing our “Hey Hill” series—addressing common client questions and sharing our perspective.

To submit a question for a future post, email us at service@hillinvestmentgroup.com.

Online scams are becoming more sophisticated, and anyone can be a target. Scammers are constantly developing new ways to access personal and financial information, whether it’s a fake email or a suspicious phone call.

We’re sharing examples of common fraud tactics we and others in the industry have observed, along with simple steps you can take to protect yourself and others.

Phishing Emails, Texts, or Letters

These are among the most common scams, and you likely encounter them daily. They’re often disguised as messages from banks, delivery services, or companies you recognize. The goal is to get you to click a link or share sensitive information.

What to watch for:

- Misspelled sender addresses or strange-looking links

- Urgent language (e.g., “24-hour notice” or “Immediate action required”)

- Requests for passwords, authentication codes, or personal data

What you can do:

- Don’t click suspicious links—hover and verify before clicking

- Contact the company directly through a known phone number or website

- When in doubt, delete the message

Impersonation Scams

Scammers may pose as government agencies (IRS, FBI, Sheriff’s Office), financial professionals, or even friends and family members in distress.

Common examples include:

- Claims that you owe money or face legal consequences unless you send funds immediately

- Urgent, secretive requests for access to your personal devices or accounts

- Promises of cryptocurrency “bonuses” or internet transfers via platforms like PayPal or Zelle

What you can do:

- Hang up and independently verify by calling an official number

- Don’t share personal information unless you initiated the contact

- Use two-factor authentication wherever possible

- Be skeptical—even caller ID can be faked

- Remember: government agencies will never request payment via cryptocurrency or gift cards

Staying Vigilant

Scammers rely on confusion and speed. If something feels off, pause and verify.

At Hill Investment Group, we take data security seriously. Our team undergoes regular training, and we maintain internal protocols to reduce cybersecurity risks. We also partner with a large custodian that maintains dedicated fraud prevention and monitoring teams.

If you’re unsure whether something is legitimate—or if you just need a second opinion—don’t hesitate to reach out to us or a trusted family member. We’re here to support your financial well-being and help you stay secure in an increasingly digital world.

Disclosures:

This material is for informational purposes only and does not constitute legal, tax, or investment advice. Hill Investment Group is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training. Always consult with your professional advisors before making decisions related to your personal security or financial situation.

The Tax Law Changed. Our Approach Hasn’t.

There’s no shortage of uncertainty these days. Between shifting political priorities, market volatility, and changes in legislation, it can feel hard to keep up.

But taking the long view means you don’t have to because that’s exactly what we’re here for.

The new tax and spending legislation signed into law over the July 4th weekend is significant. We’re already evaluating its implications through the lens we bring to all planning topics: simplicity, cost-efficiency, and long-term alignment. Below, we’re sharing a summary of the key changes and potential impacts worth noting.

As always, we’ll coordinate with your tax and estate planning professionals and bring relevant insights into our upcoming planning conversations when appropriate.

The Hill Viewpoint

At Hill, we return to a few core principles again and again:

Keep it simple. Keep it low cost. Keep it liquid.

We’re running the new tax changes through that same lens—separating what’s useful from what’s noise, and focusing on what could enhance your long-term plan without adding unnecessary complexity.

We’re here to help you take the long view, stay steady through change, and, most importantly, simplify the financial side of life so you can focus on what matters most: time with family, meaningful experiences, and the freedom to enjoy the life you’ve built.

If you have questions about how this applies to your situation, let’s connect. We’re happy to discuss what it may mean for your plan.

What We’re Watching

Investments

Key Point:

With tax rates locked in and fewer Alternative Minimum Tax (AMT) concerns, depending on your situation, there may be more room to plan investment income, withdrawals, and Roth conversion strategies.

Income & Tax Planning

- The lower tax brackets enacted in 2017 are now permanent, offering more certainty for long-term planning.

- Deductions for state and local taxes (SALT) have been expanded through 2028—potentially benefiting residents in higher-tax states.

- Fewer taxpayers are expected to be affected by the AMT, which could support more flexible income planning for those with incentive stock options or who itemize deductions.

Retirement Accounts

- No direct changes were made to IRAs, Roth IRAs, or required minimum distributions (RMDs).

- With lower rates remaining in place, planning strategies like Roth conversions or flexible withdrawal sequencing may gain added relevance—especially for those with significant pre-tax balances.

New Accounts to Watch

- A new federally sponsored savings account program for children born between 2025 and 2028 was introduced. While sometimes referred to informally as “baby bonds,” this savings vehicle offers a $1,000 contribution per eligible child.

- Use of these funds will be restricted to specific purposes, and more guidance is expected from federal agencies.

- These accounts are unlikely to be more favorable than existing vehicles like 529s from an investment perspective, but they may play a complementary role in family savings plans.

Estate Planning

Key Point:

The higher estate exemption offers more planning flexibility and may prompt a fresh look at existing trust structures.

- The estate tax exemption will increase to $15 million per person ($30 million per couple) starting in 2026.

- This higher threshold is currently permanent unless changed by future legislation.

- This could reduce the need for complex estate planning structures or insurance-based strategies tied to estate tax obligations for some families.

Tax Law Highlights

Key Point:

Several provisions offer expanded deductions and planning opportunities, especially for retirees and those with variable income.

- The standard deduction remains high, reducing the need for itemization in many households.

- New deductions for tip income (up to $25,000) and overtime pay (up to $12,500) will apply through 2028 for eligible earners.

- A new $6,000 deduction for individuals age 65+ is also included, with similar sunset timing.

Charitable Giving

Key Point:

Charitable giving remains a powerful planning tool, but new thresholds make strategy more important.

- Beginning in 2026, non-itemizers can deduct up to $1,000 (individuals) or $2,000 (joint filers) in charitable gifts.

- For itemizers, deductions only begin once gifts exceed 0.5% of income.

- For business owners, deductible giving now requires contributions greater than 1% of income.

- As a result, tactics like “bunching” gifts or using donor-advised funds may become even more relevant.

Education Planning

Key Point:

Families assisting with education costs may benefit from expanded 529 rules and student loan changes.

- Starting in 2026, borrowing limits will apply to certain federal student loans (Grad PLUS and Parent PLUS).

- Simplified income-based repayment plans are replacing current programs.

- 529 plan usage has expanded: families may now use up to $20,000 per student (up from $10,000) for elementary or secondary tuition—including private or religious schools.

- Qualified 529 expenses now include some non-tuition costs for K–12 education and costs related to professional credentialing.

Insurance

Key Point:

The expanded estate exemption may reduce the role of life insurance in certain estate plans.

- No direct changes were made to life or long-term care insurance rules.

- However, some clients may find they no longer need insurance to offset estate taxes.

- This could be a good opportunity to reevaluate existing policies or trust structures in light of broader estate planning goals.

Final Thoughts

As we digest the details of the new law, our approach remains unchanged: stay focused on what matters, filter out the noise, and align each opportunity with your long-term goals.

When the landscape shifts, we stay steady, so you can too.

Disclosures:

This material is intended for general informational purposes only and should not be construed as investment, legal, or tax advice. The views expressed are those of Hill Investment Group and are subject to change. Always consult your financial, legal, or tax professional regarding your specific situation. Hill Investment Group is an SEC-registered investment adviser. Registration does not imply a certain level of skill or training.