Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

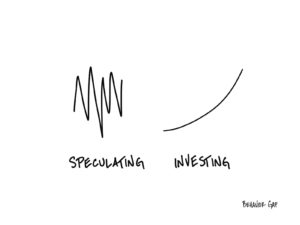

Speculating Versus Investing

Speculating and investing are fundamentally different, and it pays to know why.

Speculating is exciting, full of breathtaking ups and downs. If you chart it over time, it looks like a heartbeat. Probably an elevated one.

Investing, on the other hand, is slow and boring. In the short term, you may have some ups and downs. But if you chart investing over time (over many years of time), it looks like a long slow curve upward.

Speculating is like a Vegas casino. Investing is like watching grass grow.

Know which game you’re playing.

Compounding Wisdom: Banking 101

This is the latest in our series of introductory “101” financial guides. Each guide reveals a set of wise actions as well as a set of behaviors to avoid. The goal? Help you make smart choices at every turn in your financial road trip. We have seen financial successes exponentially enhanced when wise financial decisions are made repeatedly over a long period. This month’s focus is Banking. Online banking, online banks, and fintech firms are rapidly changing the competitive landscape, so staying up to date can be challenging.

Compound Wisdom Actions

- Good Things Come in Threes – A great start is 1 checking account, 1 savings account for your emergency fund, and 1 savings account for near-term large purchases.

- Know the Fine Print – Understand the fees within your account and how to avoid them.

- Don’t Live on the Edge – Keep a cushion in your checking account to avoid overdrafts.

- Know Where You Stand – With smartphone access and reduced use of checks, it’s easy to know your real balance and there is less need to “balance your checkbook” each month.

- Hold On – Plan ahead so you aren’t surprised when a deposit is placed on hold and the funds are not instantly available.

- Stay Alert – Review your account’s balance and transaction alert settings and update them to match your preferences.

- Stay Safe – Enable two-factor authentication, and never access your bank app on public Wi-Fi.

- Go on Auto-Pilot – Use your checking account as a hub to auto-pay your bills instead of a credit card (which may be reissued every time fraud is suspected).

- Get the Kids Involved – A savings account for a child in middle school can be a great tool to start them off in learning about banking.

- Don’t Simply Pass it Along – Young adults should investigate the low-cost nature of online banks and not just adopt their parent’s brick-and-mortar bank.

- No Interest – While the national banks continue to offer low-interest rates on checking accounts, many online banks pay cashback when you use their debit card, making it a potentially wise choice for younger adults.

Behaviors to Avoid:

- Over-drafting Often – Regular overdrafts signal you are not in control of your finances.

- Surprise, Surprise – Not knowing your balance weekly or even daily can result in a costly surprise.

- Banking Inertia – If your bank is assessing fees or delivering poor service, pull the plug and find a better solution.

- Paying Avoidable Fees – If you are being assessed fees each month, you should ask how to eliminate them.

- Walking Around with Your Emergency Fund – Never use your checking account as a place to save for emergencies – create a dedicated savings account that is less easy to access (aka no debit card).

Feel free to pass this along if you know someone who might benefit from the guidance and look for more from me in this monthly series.

I lead our Hillfolio level client service and planning efforts, learn more about me here and reach out if I can help you put the magic of compounding on your side.

Broken Clocks are Right Twice a Day

Does anyone know when to get in and out of the market? Many professionals try, and we’ve heard a few theories from amateur investors lately. It’s tricky to tell fact from fiction. There are a million ways to analyze historical data to find timing patterns that appear to produce attractive returns. The real question you need to ask yourself: “Is there any reason why I should expect that pattern to continue in the future, or is it purely due to chance?”

An example. Over the last thirty years, if you sorted stocks based on the letter of the alphabet they started with, you would see that stocks that began with the letter “M” outperformed those that started with the letter “E.” Is there any reason to suspect this to continue over the next 30 years?

No, clearly, the letter of the alphabet should have no impact on a company’s returns. The reason for this difference is that Microsoft was a large, successful company over this period, while Enron was a large, unsuccessful company over this period.

When working with “noisy” data, the odds that the results are evenly distributed is very small. If you roll a die six times, the odds of getting each number exactly once is tiny (1.5%). That means there is a 98.5% chance you will roll some number two or more times and some number zero times.

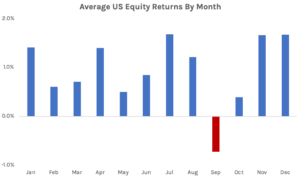

A typical market timing strategy we hear about around this time of year is to “avoid investing in the month of September.” At first thought, it seems odd that September would produce below-average returns, but when you look at the historical data, it is true!

Is there any economic rationale as to why this should continue in the future? I can’t think of any. Some claim that it is due to market participants selling positions to clean up their books after taking time off in the summer. If that were true, why wouldn’t investors try and get ahead of it and sell in August? Or why wouldn’t hedge funds gobble up all the low-priced stocks and keep prices stable?

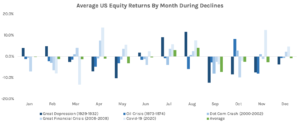

Let’s dive deeper into the data and look at the five largest market declines over the last 100 years. Each drop produced several months of negative returns, but all five of them spanned September at some point.

The recession peaked in different months every time, and every month was hit negatively at some point. However, there was bound to be one month affected more than others. It just happened to be September. From 1926 to 2021, 52% of the September months had positive returns. The large negative returns from a few market downturns have skewed the average to be negative. The question is, do we expect this to continue in the future?

Whenever you hear of these market timing strategies, you need to ask yourself if there is a logical economic rationale as to why the trend existed in the past and why it should continue in the future. Is there some risk associated with September we don’t know about? Is there some behavioral rationale that investors can’t arbitrage away? If you can’t come up with a concrete reason, whatever anomaly you are looking at is most likely due to chance and not a reliable trading strategy to implement in the future. Before accepting any investment truism, it is important to be sufficiently skeptical before implementing it yourself.

Returns from Fama/French CRSP Data Library.