Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: Philosophy

Signal vs. Noise: “The Only ETFs You’ll Ever Need” Trap

Welcome to the age of the “finfluencer.” While some have genuine experience, many are focused on views, and not your best interest. At Hill Investment Group, we believe that real advice should be simple, clear, and grounded in evidence, not hype. That’s why we’re launching a new series to unpack misleading ideas that circulate online or in print.

Our goal? To inform, not entertain. To offer substance, not speculation.

Heard something at work, at golf, or on social media that has you asking, “Should I be paying attention to this?” Feel free to share it with us. We’d love to help unpack it. Submissions will remain confidential unless we get your permission to share anonymously. Send to: zenz@hillinvestmentgroup.com

Please note: Submissions are reviewed for educational purposes only and do not constitute personalized investment advice.

If you follow finance influencers online, you’ve probably seen a version of this pitch: “All you need are these ETFs.” More often than not, that list includes VOO and QQQ, and little else.

It’s a compelling idea. Over the past decade, these two funds have benefited from strong performance by large U.S. companies, particularly the tech sector. But a closer look at what’s under the hood reveals a more concentrated and potentially less diversified portfolio than many investors realize.

What These Funds Represent

VOO is an index fund tracking the S&P 500, which includes large U.S. companies. QQQ tracks the NASDAQ-100 Index, which also focuses on U.S. large-cap companies, particularly technology-oriented names. While they are separate funds, they share many holdings.

In fact:

- Roughly 85% of QQQ’s holdings also appear in VOO.

- The overlap in weight between the two strategies is around 50%.

That means holding both may result in doubling up on the same exposures, mainly large U.S. tech and growth-oriented companies.

Additionally, QQQ’s higher expense ratio reflects the licensing cost of tracking a proprietary index, as well as required marketing efforts. While high fees alone don’t negate a fund’s merits, investors should always ask themselves if they can get similar investment exposures without the additional costs dragging down performance.

What’s Not Included

Holding only VOO and QQQ may leave meaningful portions of the global capital markets untapped. These include:

- Small- and mid-cap U.S. companies

- International developed markets

- Emerging markets

Together, VOO and QQQ cover a significant portion of the U.S. market but only represent about half of the global investable opportunity set. Omitting the other half may reduce diversification and limit exposure to other potential sources of return.

For instance, in some years, areas outside the U.S., such as international stocks, have delivered notably stronger returns than their domestic counterparts. That rotation is unpredictable and has lasted over a decade when looking at historical returns.

A Broader Perspective on Diversification

Low-cost index funds can be valuable building blocks, but true diversification often means looking beyond the most visible names. A globally diversified portfolio typically includes exposure to companies of varying sizes, styles, and geographies. This broader approach is designed to manage risk and capture returns from multiple parts of the market, not just the ones making headlines.

The Takeaway

There’s nothing inherently wrong with VOO or QQQ. They offer relatively efficient access to major segments of the market. But using them as your only strategy may leave diversification and opportunity on the table. We know you can do better. An evidence-based investment approach typically considers a wider range of asset classes, grounded in long-term academic research rather than short-term trends.

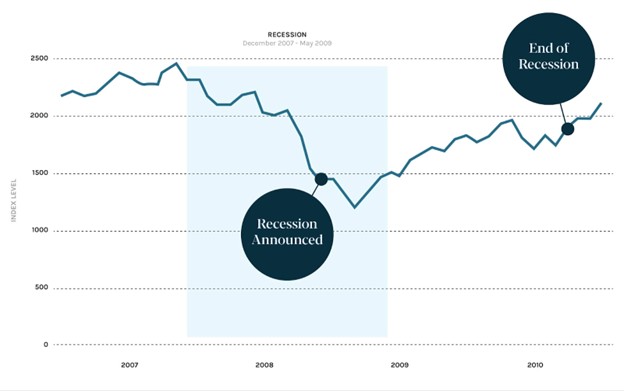

Markets Don’t Wait for Official Announcements

Over the last several months, “tariffs” have made frequent headlines. They’re on. They’re off. They’re up. They’re down. Understandably, many investors are asking: How will this affect my portfolio?

Here’s the short answer: the market doesn’t wait for official announcements—good or bad. Every second global financial markets are open, prices are adjusting in real time to reflect all known information, whether that information is accurate, speculative, or incomplete.

This is why reacting to headlines or trying to time the market based on “breaking news” often proves unproductive. The news is already priced in.

At Hill, we help clients build portfolios rooted in long-term planning, academic research, and thoughtful consideration of risk. These portfolios are designed with the understanding that market fluctuations and unexpected headlines are part of the journey.

Rather than react to each new cycle of uncertainty, we focus on your plan, your risk tolerance, and the full breadth of evidence available. This approach is intended to help clients remain invested and confident, even in the face of short-term volatility.

The included graphic from Dimensional illustrates how markets respond to news events. It highlights a consistent truth: while headlines can move markets temporarily, disciplined, diversified investors who stay the course are often better positioned over the long term.

If you have questions about how your portfolio is structured to weather market headlines—or want to revisit your plan—we’d be happy to talk.

20 Years. 20 Lessons. Still Taking the Long View.

What 20 Years Have Taught Us

Twenty years ago, we launched Hill Investment Group with a simple idea and a bit of idealism. We called our firm the Island of Idealism: a place where evidence mattered more than ego, long-term thinking trumped short-term noise, and clients could breathe a little easier knowing they had a guide they could trust.

That idealism is still with us. But over two decades, it’s been sharpened by experience. We’ve helped clients weather storms, tune out the headlines, and stay committed to plans built for decades, not days.

In the spirit of reflection, I reached out to my co-founder, Rick Hill, to help compile this list. Rick is now retired, but his thinking (and our friendship) continues to shape our work and HIG culture.

Here are 20 lessons we’ve learned in 20 years. Some are personal. Some are practical. All of them are built to last.

20 Lessons in 20 Years

1. Evidence beats emotion.

2. You don’t need to predict the future to build wealth. You need a process.

3. Costs, taxes, and behavior matter more than market forecasts.

4. Markets reward discipline, not cleverness.

5. Diversification is the only free lunch. Eat it every day.

6. A sound allocation only works if you stick with it. Education builds confidence, and confidence fuels discipline.

7. Our most successful clients are curious and engaged. They’re fun to work with, understand the philosophy, and like to delegate.

8. Listening is more powerful than convincing.

9. Trust is earned through credibility, reliability, and intimacy, not promised through performance.

10. Simplicity makes people feel smart. Complexity makes them feel confused. We care deeply about simplicity.

11. People want progress, not perfection.

12. Culture matters and should be tended like a garden.

13. High standards are contagious. So is apathy.

14. You don’t need to be big to be mighty.

15. The right people are worth the wait.

16. Saying no creates space for what matters.

17. Don’t check your portfolio when the world feels upside down. Check your plan.

18. The Stockdale Paradox applies to investing: Confront the facts, believe in the outcome. Untether from the short term.

19. Market volatility is normal. History proves it. You get paid for tolerating the bumpy ride.

20. Take the long view. It’s the only one that works.

Whether you’ve been with us since the early days or just recently joined the journey, thank you for trusting us. We’re proud of what we’ve built, and we’re even more excited about what’s ahead.

Still client-focused. Still evolving. Still taking the long view.

For your further exploration

- Hear the origin story: Matt & Rick on the “Island of Idealism”

- Read about it in Odds On: The Making of an Evidence-Based Investor

- ️Explore the Stockdale Paradox in this podcast episode