Details Are Part of Our Difference

David Booth on How to Choose an Advisor

20 Years. 20 Lessons. Still Taking the Long View.

Making the Short List: Citywire Highlights Our Research-Driven Approach

The Tax Law Changed. Our Approach Hasn’t.

Category: A piece we love

Frugal vs. Independent

Morgan Housel does it again in this recent piece. We think you’ll like it for the same reasons we do which are several because it engages your mind, heart, and soul. Are you frugal, independent, or something else entirely? Is long-term investment success dependent more on knowledge or behavior? Either way, do you invest alone or with a trusted advisor? And possibly most importantly and challenging to do, answering the question for and about yourself, “What’s my relationship with money?” That answer will likely make answering the prior questions much easier; however, this keystone question is often unasked and unanswered because it’s so hard for most of us to confront because it gets to our deepest essence. Let us know if you’d like our help discovering your answer.

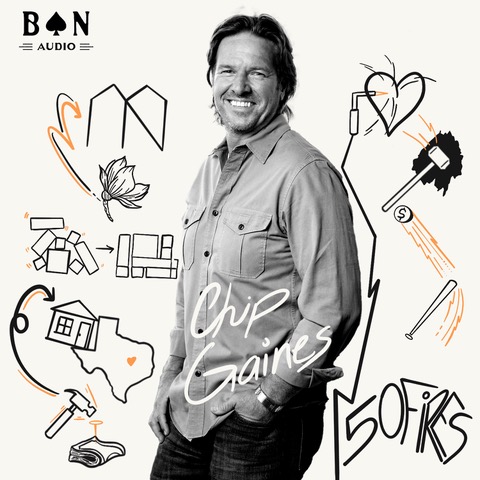

Money As a Tool for Impact with Chip Gaines

If you’re a long-time reader of our content, you recognize the name Carl Richards. Carl is the former New York Times writer and artist known as the “sketch guy.” He’s also an author and hosts two podcasts (plus a great friend). What’s the common thread in all his content: money and meaning. Carl lives and works at that intersection. His latest podcast, called 50 Fires, is intended to explore this connection with various successful and thoughtful friends. Here’s a fun place to start if you’re interested in thinking more deeply about what money means to you and your family.

People & Pets

Many of our clients, friends, and team members have pets…dogs, cats, horses, fish, and many others. Our family has been blessed with a wide range, including fish, turtles, bearded dragons (Puff & Flame), a rabbit (Thumper), and a European Blue Butt Potbelly pig (Corny)…topping out at 350 pounds plus.

Sadly, last week, we lost our closest and most senior family pet, Teddy the Miracle Yorkie, after 15 amazing years of love and companionship. Teddy was a miracle because I’m allergic to almost every dog…except Teddy! We populated many of our friends’ homes with our six prior attempts at living with a dog. Jeana is a true Master Trainer, and she bore most of the pain as these dogs brought joy to others. Most of them lived long, wonderful lives with their ultimate family, and we had the opportunity to see them regularly…just not under our roof.

Teddy remains the best birthday present my wife, Jeana has ever received, and Teddy was a blessing to all of our kids. I could go on about his gentle nature and soul, his warm and friendly demeanor, and his ability to bark like a dog ten times larger than his 9-pound frame. If I continue, I will cry more than I am now. So, I will turn you over to a friend of our firm who you’ve heard from before, John Jennings, who also recently lost a dog, Dylan. John eloquently shares ”Six Life Lessons from Dogs,” which he originally wrote in 2022.