Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

Category: Philosophy

Legend in Investing – Charles Ellis

Do you want to see and hear an investment legend interviewed by two of the nicest and smartest advisors I know? Tune into this episode of the Rational Reminder podcast with guest Charles Ellis, famous author, investing authority, and a top-notch communicator.

Cameron Passmore cohosts the Rational Reminder and is someone I consider a friend. He and his talented partner, Ben Felix, run one of the best podcasts related to investing. If you like this episode I suggest subscribing to their channel.

Here’s the rundown of what’s covered:

0:00 Intro

4:18 Charley defines a “Loser’s Game”

8:21 Why money management is a loser’s game

11:38 How the market has changed since writing about the loser’s game

19:09 Whether or not the sentiment toward active management is negative

22:03 Types of investor who should not invest in low-cost index funds

30:27 What investors and their advisors should be focused on

37:25 The importance of a well-defined investment policy statement

39:01 What investors can do to protect themselves from themselves

40:43 The most under-appreciated action investors can take to be more successful

50:16 Charley’s opinion on Vanguard’s entry into private equity

55:27 Where Charley sees the biggest future opportunities in the field of investment

1:00:15 What has made Vanguard successful as a company

1:08:14 What Charley has learned about personal motivation and productivity

1:12:04 Charley defines success in his life

1:14:12 Outtake

If you’d rather listen to the episode instead of watching on YouTube here is a link via Apple Podcasts.

April Showers…and Taxes

If it’s April, taxes are on the minds of most Americans. Based on decisions made throughout the prior calendar year, investors might be caught with a nasty tax surprise and need to write a large check to Uncle Sam. We consider your taxes daily to avoid these surprises at Hill Investment Group. Practices we implement, like tax loss harvesting and asset location (tax-inefficient asset classes in tax-deferred accounts), can meaningfully reduce the taxes an investor may owe annually. However, we are talking about one of the most impactful practices today: investing in ETFs rather than mutual funds.

ETFs and mutual funds are two types of investment vehicles and are simply different ways of holding a group of underlying securities like stocks or bonds. Most investment strategies can use either structure to execute their investment strategy. For example, Dimensional Fund Advisors and Avantis Investors, two companies we invest with, have both a mutual fund and an ETF for their US Small Value strategies. For each firm, the strategies are run the same way. However, they have a different legal structure that, in turn, has different tax consequences.

ETFs rarely distribute capital gains at the end of the year because of the way they rebalance and trade.

On the other hand, mutual funds almost always distribute some capital gains. The table below outlines the capital gain distributions for four specific funds in 2022.

| Vehicle | Ticker | Fund | Capital Gain Distribution (%) | Taxes Owed (%) |

| Fund | DFSVX | Dimensional US Small Cap Value Fund | 5.0% | 1.0% |

| ETF | DFSV | Dimensional US Small Cap Value ETF | 0.0% | 0.0% |

| Fund | AVUVX | Avantis US Small Cap Value Fund | 5.6% | 1.1% |

| ETF | AVUV | Avantis US Small Cap Value ETF | 0.0% | 0.0% |

Both the mutual funds distributed ~5% of their value in capital gains, whereas the ETFs did not distribute any. This means that investors in the mutual fund owed about 1% (assuming a 20% capital gains tax rate) in taxes to the government. For every $100,000 invested in the small value strategy, they owed $1,000 in taxes this April. Investors in the ETF, the same strategy but with a different legal structure, owed $0 in taxes this April.

By investing primarily in ETFs across our models, we avoid capital gain distributions for our clients in those funds and meaningfully reduce their tax bills yearly.

Let me know if you have questions or comments about this or any other investment-related topics by emailing me at: zenz@hillinvestmentgroup.com.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. Past performance is not indicative of future results.

Play this Game

Timing the market can take on many different forms, but we’ve all done it at some point in our lives, even me. Sometimes the market is at an all-time high and we feel there is no way it can keep going up for much longer. We decide to wait for that market correction before investing. Sometimes there is turmoil in the world, markets are falling, and we want to wait to invest until that volatility subsides. In the moment, it always seems to feel obvious what the correct “market timing” strategy is.

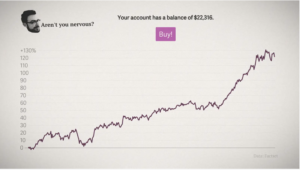

Unfortunately, in the real world, timing the market is extremely difficult to do. As a firm of investment professionals, we recently tried to artificially time the market during a team Zoom…and we failed miserably. We used the website: Try to Time the Market to test ourselves. The website simulates a random 10-year historical return sequence from the US stock market. Over those ten years, you get one chance to sell and go to cash, and one chance to buy back into the market. You will beat the market return if you pick the right time to get out and get back in. Sounds easy, just sell when the market is at a high, and buy when it’s at a low.

As a firm, we only outperformed the market 40% of the time. Meaning 60% of the time, we would have been better off if we had just stayed invested the entire 10-year period. To make matters worse, when we did beat the market, it was only by a few percentage points, but when we lost to the market, it was usually by 50+%.

The game only takes a minute to play. Give it a few tries, and see how you fair. We’d love to hear how you did.

Why did we fail at trying to time the market? On average, the market goes up a few hundredths of a percent every day. This means that each day your money is out of the market you are losing out on that potential gain. If the market actually went up a tiny bit every day, no one would ever think to try and time it. However, the volatility of the market makes trying to time it so enticing. If you just avoid some of those bad days, months, or years, it can make a drastic difference in your net wealth. The trouble is if you miss out on those great days, months, or years, it can also make a drastic difference in your net wealth. Given, on average, that the market goes up every day, you are better off not trying to play the timing game and simply stay invested.

You’re better off taking the long view.