Details Are Part of Our Difference

Embracing the Evidence at Anheuser-Busch – Mid 1980s

529 Best Practices

David Booth on How to Choose an Advisor

The One Minute Audio Clip You Need to Hear

New Feature: “Hey Hill, how can I…”

Addressing Common Client Questions

At Hill Investment Group, we recognize that when a few clients raise the same question, it’s likely that many more have similar thoughts. To better serve you, we’re introducing a new segment in our newsletter where we’ll address common questions and how we approach them. The goal is to address what’s top of mind for our clients. To submit questions for future newsletters, email us at info@hillinvestmentgroup.com

This month, we’ll debut our first frequently asked question:

“Hey Hill, how can I secure a high rate of return for my cash savings?”

Understanding Cash Savings:

Every investor has to hold on to some amount of cash. We all have daily bills and expenses, something big we’re saving for, or just want something set aside for emergencies. This is money you want to keep safe. As you’ve likely noticed, cash sitting in your bank account earns very little and it may feel like you’re missing out on potential earnings. The great news? You have options at your fingertips, that we can help you take advantage of.

Why does this matter? Ensuring cash is managed effectively is one of the best ways we can help you “pick up the pennies” of extra return around the edges of your portfolio.

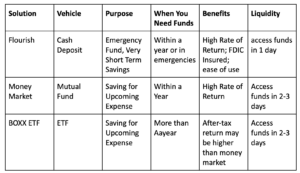

For earning a return on cash, we recommend three options, tailored to your specific situation:

- Money Market Funds

Money market funds invest in highly liquid, short-term debt instruments like US Treasury bills. These funds offer high liquidity and very low risk, making them a secure option. Investors in money market funds can expect a positive return, currently around 5%, matching the returns on short-term US government debt. We recommend money market funds for cash you plan to use within the next year. We can manage this investment for you, ensuring your cash earns the highest return with minimal risk.

- BOXX ETF

BOXX is an ETF providing money market-like returns but in an ETF format. This means returns are reflected in the increasing price of the ETF rather than as income. Since capital gains are taxed at a lower rate than income, holding BOXX for over a year could significantly enhance your after-tax return.

We recommend BOXX for cash that you plan to hold for more than a year. We can manage this investment and monitor the holding period to maximize your after-tax return.

- Flourish – New Service Announcement!

We are excited to introduce Flourish, a new service for Hill Investment Group clients. Flourish removes the hassle of hunting for the highest savings account rate by partnering with over a dozen FDIC-member program banks to ensure you always receive the highest savings rate. Flourish links to your personal checking or business account and offers money market-like returns and up to $10 million in FDIC insurance. This all comes with no fees or minimums and a clean, user-friendly interface.

We recommend Flourish as your high-yield savings account solution for cash held in personal accounts. We can help you set up Flourish to talk to your personal accounts hassle-free so you know you are getting the most out of your cash at all times.

We’ll be rolling out this service over the coming months, but if you are curious to dive deeper – Check out this 5-minute video. If you’re eager to start using Flourish now, email us, and we’ll send you an invite so you can start benefiting immediately.

We’re here to ensure your cash works as hard as you do. Let us help you maximize your returns with minimal risk.

Summary

This information is educational and does not intend to make an offer for the sale of any specific securities, investments, or strategies. Investments involve risk and, past performance is not indicative of future performance. Return will be reduced by advisory fees and any other expenses incurred in the management of a client’s account. Consult with a qualified financial adviser before implementing any investment strategy.

Welcoming Matt Zenz as a New Partner

We are thrilled to announce that our CIO, Matt Zenz, is officially joining our leadership team and becoming a partner. Matt’s extensive experience in our evidence-based approach to investing makes him an invaluable addition to our leadership team.

Matt has an impressive background in systematically managing assets across multiple strategies. His career includes significant roles such as Chief Investment Officer at Hill Investment Group (past 3 years), Product Specialist at Stone Ridge Asset Management, and Portfolio Manager at Dimensional Fund Advisors, where he managed over $80 billion in U.S. small and mid-cap equity assets.

Matt holds an MBA from Harvard Business School, a Master’s in Electrical Engineering from the Ohio State University, and graduated Magna Cum Laude from the University of Notre Dame with a Bachelor’s degree in both Electrical and Mechanical Engineering. His academic accomplishments are bolstered by his practical experience in and deep knowledge of multi-factor investing and asset pricing.

Throughout his career, Matt has been dedicated to engaging with clients, ranging from sophisticated institutional investors to families and individuals. His ability to clearly communicate and implement our research-based approach has been instrumental in building strong client relationships with clients and HIG teammates.

When asked about why Matt loves his work and what it means to him he said “I care about and seek truth in all things – I just happen to love doing that most within investing. Helping clients find that truth about their financial situation brings me great satisfaction.”

Matt will continue to leverage his extensive expertise and leadership skills as a partner to drive our firm’s mission of delivering exceptional evidence-based investment solutions. His addition as partner marks not just a new chapter but a potential turning point for Hill Investment Group as we strive to enhance the quality of our services and help achieve your long-term goals.

Please join us in celebrating Matt Zenz as our third partner!

(Matt Hall and Nell Schiffer are the other firm leaders and owners)

Stay tuned for more updates and insights from Matt and the rest of our team as we strive to excel in serving our clients and the broader financial community!

Welcoming our Summer Intern

As the summer season approaches, we are thrilled to welcome a new Hill Investment Group family member. Our new intern, Kellen Williams, is excited to spend the summer with us, and we are equally happy to have him on board.

Kellen joins us from Lindenwood University, where he is currently pursuing a degree in Finance, and he is expressing interest in the Chartered Financial Analyst (CFA) program. His passion for finance and investments started when he was only 14 years old after purchasing his first share of stock! Combining his eagerness to learn and contribute with his keen interest in Hill Investment Group makes him a perfect fit for our team.

“I had a very warm welcome from the team during my first week,” Kellen shared. “I’m looking forward to immersing myself in different parts of the business, learning new skills, and assisting in any way I can. I’m especially excited to see how client portfolios are managed and optimized.”

Throughout the summer, Kellen will work closely with our team, gaining hands-on experience in various aspects of our firm. From operational projects to assisting in the backstage service area, he can apply his academic knowledge in real-world scenarios.

At Hill Investment Group, we believe in nurturing young talent and providing a supportive environment for growth and development. Our team is committed to mentoring Kellen and ensuring he gains valuable insights and skills to benefit him in his future career while also serving our most crucial asset…our clients.

Please join us in welcoming Kellen to the Hill Investment Group team. We look forward to a productive summer with him.

Stay tuned for updates on Kellen’s journey with us, and, as always, thank you for your continued trust and partnership.